Have we accomplished what we set out to do more than a decade ago? Have we altered the financial services landscape?

Did we actually change the narrative?

Financial technology, implemented thoughtfully, can act as a gateway to include more unbanked and underbanked within the formal financial services system. It can help serve people better, providing more relevant services to a wider demographic, including women, gig workers, people of colour, and small businesses. Implemented with emerging technologies such as artificial intelligence and advanced analytics, it can also help to improve consumer financial health and long term financial security. This is critical to improve lives across generations.

While consumer awareness of various money transfer and payments solutions is fairly high, FinTech adoption in North America in general is still low (46% in the U.S. and 50% in Canada), compared to emerging markets such as China and India (both at 87%), according to EY.

But this is rapidly changing. With COVID-19 and the need for social distancing, more consumers have turned to digital tools — those provided by both FinTech startups and incumbent financial institutions. Interestingly, but not surprisingly, PayPal reported that people over 50 are the fastest growing segment over the past few months. It just demonstrates what we’ve always believed in — digital adoption is not limited to “digital-native” generations. There is a larger market to be had, if we would shed our biases and create truly inclusive solutions that encompasses all people — regardless of age and socio-economic background.

Home is where the heart is

Talent is equally distributed; opportunities are not.

When it comes to innovation, we often think about the big coastal cities like New York and San Francisco. But such thinking limits us to the talent that we have access to, and the challenges — hence opportunities — that are the purview of smaller and more local communities.

The current pandemic has forced us to re-evaluate how (and more importantly where) we live and work. With many workers being able to work remotely at least for the foreseeable future — estimated to be between 85 and 110 million people over the past few months — we have an opportunity to expand our ecosystem and to leverage more local talents.

There are nearly 9,000 community banks and credit unions in the U.S. today, which is more than the number of banks of any size in any country in the world. Community banks are pillars of local neighborhoods, especially those in rural areas where they are often literally the only financial institution in town. And as we have seen from this pandemic, they are crucial in supporting local small businesses on every Main Street in every town — the very backbone of our complex economy. They serve segments of the population who otherwise have fewer suitable options through larger national banks.

Unfortunately, the number of community financial institutions has been in slow decline the last several decades, through mergers and acquisitions and challenging economic times during the Great Recession. We must do more to help these institutions survive the current challenges, and innovate for the future. The vitality of our local communities depend on them.

What does the future hold?

Beyond local, the future is increasingly virtual — or shall we say, multi-channel. Meeting your customer where they are has gained importance and momentum in the last few months. Digital is no longer a nice-to-have, but a tablestake. From budgeting and financial planning, to lending and payments, consumers demand seamless and holistic experiences from their providers.

This presents an opportunity for financial institutions who can rise to the challenge, to leverage their brand and scale, along with technology and data to create unique experiences. Through collaboration with FinTech and independent software partners, banks and credit unions can expand their offerings, offer personalised guidance during times of turmoil, and become a true customer advocate.

But the road to democratisation of financial services is not always a straight line.

As the recent tragedy of the suicide of the Robinhood trader illustrated, with power comes great responsibility. Have we become so intent on growing our user base that we have ignored the humanity behind each customer? Have we abandoned our duty and commitment to our community and grown reckless over time? Have we been too focused on breaking down the barriers to investing and trading, that we have ignored the fundamentals of financial education?

How can we, as an industry, do a better job in protecting the consumers while democratising financial services? How can we be more inclusive while ensuring we are supporting the diverse needs of our broader communities in which we serve?

It would appear that our open banking journey is still at its infancy, especially in light of the fact that we have so much more to do to serve the very basic needs of all members of our society.

Unlike Europe and Asia, however, there are few formal open banking initiatives in the U.S.

When consumers sign up for services with FinTech firms such as Venmo and Acorns, they go through account aggregators such as Plaid and Finicity, which obtain customer credentials through screen scraping. Such a mechanism is less than secure, when compared to data exchange via API and tokenized authentication.

While there has been chatter about what the CFPB, OCC, or FDIC can or should do in regards to consumer financial data rights, it will likely be a long while before anything is implemented. Some states, like California, have instituted their own extensive data protections like the California Consumer Privacy Act (CCPA) which came online in January, 2020 and goes beyond the protections and transparency of even Europe’s General Data Protection Regulation (GDPR). But we need a federal mandate to protect all citizens, regardless of their state, and regardless of their financial condition.

So, where does that leave us?

Rebuild better

As Anna Hamilton wrote recently, “the purpose of banking — which has been brought into sharp relief by the current public health and economic crisis — is to democratize the ability to achieve financial security and build wealth.”

It’s about time that we put consumers’ well-being in the centre of everything we do.

Let’s rebuild better — with a renewed purpose.

Let’s make banking better and more inclusive — for everyone in our society.

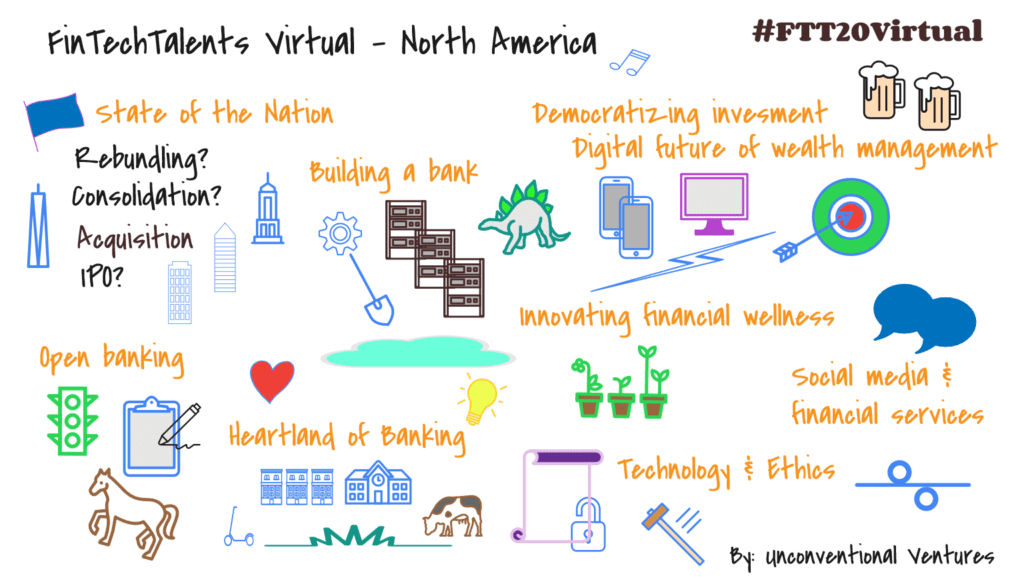

Join us Sept 9 at for FinTechTalents Virtual – North America, as we discussed these topics and more.

Theodora Lau & Bradley Leimer of Unconventional Ventures