The Great Resignation – Banking the creator economy

A great guest post from Clare McKeeve about how Talenthouse supports those who are ready to put their creativity into action and forge their own career paths. The creator economy holds enormous potential but brings with it unique financial needs. An understanding of those needs, underpins the creation of ElloU, a money-management apps created by Talenthouse.

______________

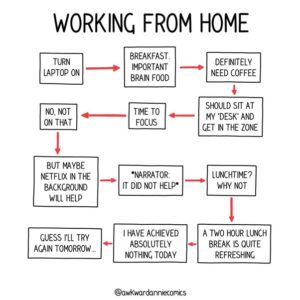

Countless studies about our working behavior post-pandemic has shown that we’re in the midst of The Great Resignation, and that more people than ever are taking their professional lives into their own hands and working for themselves. Swathes of us are choosing to not go back to the office; to leave the commute and the routine work behind and to become our own bosses.

This means that there’s currently huge growth in the creator economy. Already pre-COVID, it was estimated that more than 50m people worked in the creator economy, and that number is multiplying. Companies are looking to tap the best creative talent no matter where these people reside. Consumers are looking for greater craftmanship, in everything from coffee they drink to the series they watch on TV, and creatives like you are seeing the opportunity to turn their passion into their livelihood.

The traditional problem with doing what you love, though, is that your finances become unpredictable. Leaving fixed salaries, pension schemes and holiday-pay and replacing them for invoices and unpredictable project income can be scary, to say the very least. But it doesn’t need to be.

Yes, banking is still rooted in the world of fixed salaries, fixed abodes and fixed assets. Try getting a bank account if you’ve just moved countries. Or try getting a mortgage if you can’t show months of salary slips! It’s hard because bank processes and decision-making are still industrial age. And, when available, it’s expensive because banks need to compensate for the risks they think they’re taking – and to cover the money they spent on acquiring the customers. All in all, it’s a raw deal for creatives.

At Talenthouse, we’re looking to change this.

We are launching a money management service of our own, called ElloU.

It’s built specifically for creatives because, as the world’s largest creative community with over 14 million members, we understand them and their needs.

The key to ElloU is that it is contextual and holistic.

We are not a bank – for the banking services we are relying on third-parties, like our European partner Vodeno – but we deal with creatives every day. We see the great work they produce. We see how many projects they are working on. We see the pipeline of projects that match their skills set. In other words, we have greater insight because we have greater context, which is one of the key advantages of embedded finance. As a result, we don’t need months of payslips to know if they are creditworthy. We don’t need to charge them 59.9% APR on an overdraft if they need an income advance.

By holistic, we mean that ElloU is designed to cater for the full financial and commercial lives of our creative community. We know their jobs to be done. In addition to all of the banking services they want – from income smoothing to simple savings and investment services – we also know they would like help running their business, from accounting to invoicing, as well as access to great deals. And we intend to provide all of these services as part of ElloU, along with all of the rich engagement features that nudge creatives towards making better financial decisions and improving their financial health.

The creator economy is setting people free, to make their living from doing what they love. At Talenthouse, we don’t see why this professional freedom should come at the cost of financial freedom. This is why we are launching ElloU, our money management services for creatives. To remove the trade-offs. So that our creative community can say hello to professional and financial freedom.

Written by Clare McKeeve, Group CEO Talenthouse