“Banking is necessary, but banks are not” Bill Gates’ 1994 famous quote is the realisation of the concept of embedded finance: The integration of financial services that are adopted by non-financial institutions.

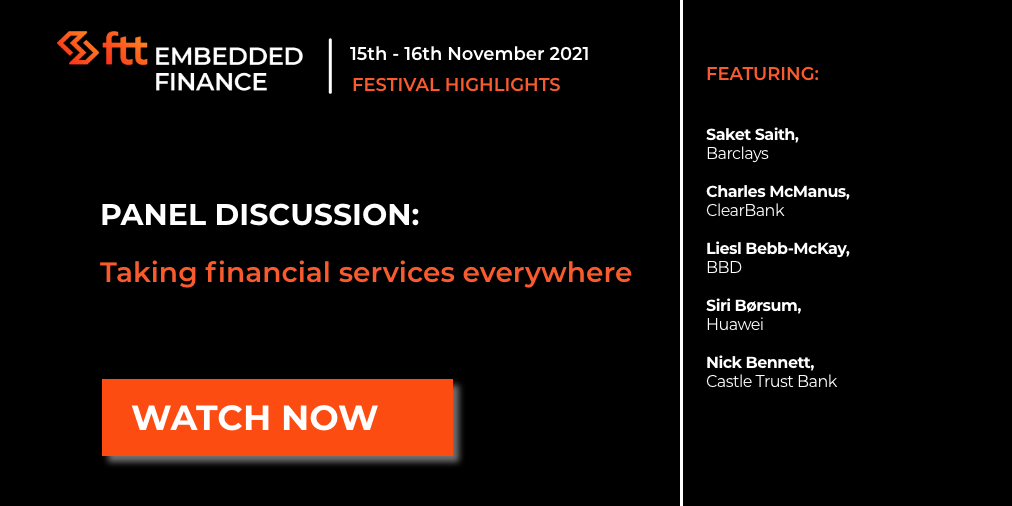

At FTT Embedded Finance UK & Europe 2021, our panel of rockstar speakers debated the big questions in embedded finance: How can we successfully integrate financial services in non-financial products at a deeper level? How is open banking catalysing embedded finance?

Charles McManus, CEO at ClearBank, explained the importance of embedded banking: “We were used to the multi-service large players, and thanks to fintech, that is unbundling: It is now all about products and services challenging the status quo, and it is the fintechs that are driving that change.”

Saket Saith, CTO at Barclays, argued that customer demand and expectations, technology, and coopetition (rather than competition) are the three key drivers of the accelerated adoption of embedded finance solutions that we are experiencing.

Elaborating in how the consumer fits in this landscape, Siri Børsum, Global VP Finance Vertical Eco-development & Partnerships at Huawei, explained how embedded finance is helping consumers to make a step change in financial health and literacy.

The panel also highlighted how embedded finance is playing a key role in helping address customer needs, such as expanding access to underserved segments. Nick Bennett, Chief Technology and Operations Officer at Castle Trust Bank commented “What is exciting about embedded finance is that we are offering services in context, which makes it much more compelling from a user experience perspective.”

Watch the full panel discussion below:

Join us for FTT Embedded Finance UK and Europe (28th of April 2022, London). We are excited about continuing to grow this innovative community that goes well beyond the traditional borders of financial services.