Kallyas is an ultra-premium, responsive theme built for today websites.

T (212) 555 55 00

Email: sales@yourwebsite.com

Your Company LTD

Street nr 100, 4536534, Chicago, US

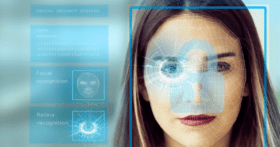

Fighting money laundering with face biometric verification The Financial Conduct Authority (FCA) wrote an open letter in May 2021, to retail banking chief executives in the UK. It raised concerns surrounding weak financial crime controls and anti-money laundering (AML) compliance in the sector. UK retail banks were mandated to analyze, identify, and resolve issues around “common control

Rod Boothby, Global Head of Identity at Santander, explores how the failure to verify every software developer’s digital identity, creates a backdoor for hackers, increasing the threat of ransomware and other cybersecurity risks. Most people do not know how modern software is built. People imagine a lone brilliant developer retreating into a dark room for

Introducing a brand new podcast from our friend and partner Transunion: Data, Strategies and Trust. Listen now to our first episode discussing fraud trends within FinTech. Digitisation, the fundamental pillar of FinTech, has become more critical to businesses since the start of COVID-19. This can be seen in the rise of demand for online finance

Even prior to the outbreak of COVID-19, instances of identity fraud and financial crime were increasing at an alarming rate. At FTT Identity 2021, a panel of experts from Trulioo, Cifas and NatWest Group came to the conclusion that these threats will never entirely go away. Financial insitutions can only minimise risk by adapting to

Your weekly resource for noteworthy news, fascinating features, and fintech titbits that caught our eye. Whether you live by your Twitter lists, save your Google Alerts or simply scroll through LinkedIn for insights and commentary – there is a wealth of content that weaves a global story around fintech. Our job at Fintech Talents is

In today’s increasingly digital, experience-driven financial landscape, one of the major challenges facing any financial institution is how to be certain of a customer’s identity. Accurately, securely and seamlessly, while meeting evolving regulation. As transactions grow in volume and complexity, customers expect ever more streamlined experiences, regulators demand greater insights, and the risk of identity

Even prior to the outbreak of COVID-19, instances of digital identity fraud and theft were increasing at an alarming rate. Experian’s Global Identity and Fraud report, launched in January 2020, found that 3 in 5 businesses had reported an increase in fraud incidents over the past 12 months. In the UK, fraud prevention service Cifas