US-based biometric authentication platform ID R&D holds court on both sides of the coast in America – in New York and Silicon Valley. While they work on solving the problem of providing user- friendly customer on boarding without compromising on security – the team like to sit back and listen to folk-inspired rock music straight from Nashville, Tennessee.

What is ID R&D – what problem are you solving?

Security is a crucial component of any customer-facing financial application. Yet, current means of authentication are generally weak if they’re easy to use, and cumbersome and time-consuming if they are secure. The result is a frustrating experience.

At ID R&D, we believe traditional logins are failing users and banks alike. The average person has too many to remember. Weak static passwords aren’t safe and strong passwords are frequently forgotten, exposing both the customer and the bank to fraud.

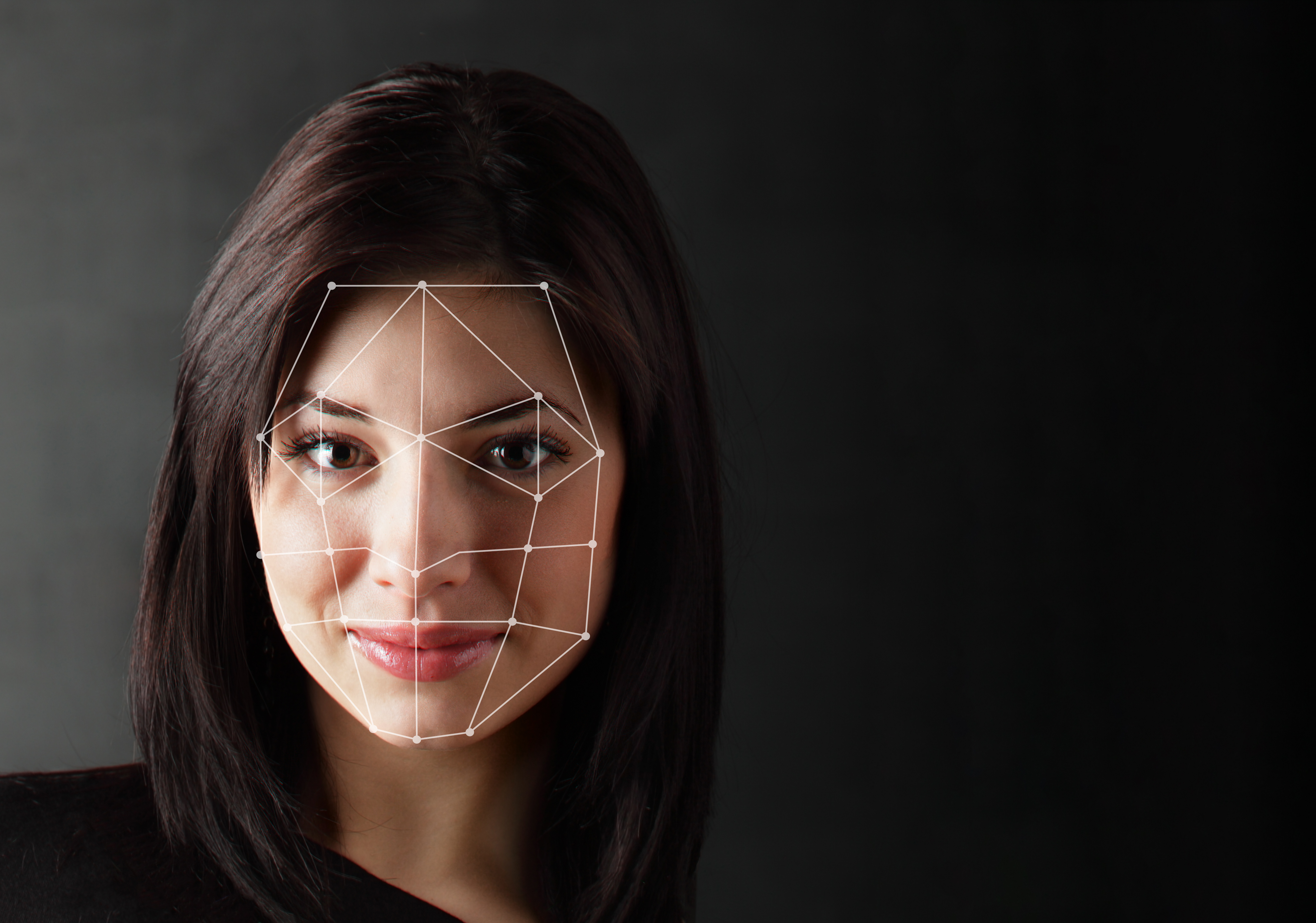

Biometrics offer a means to authenticate customers in a user-friendly way and at the same time offer higher security. However, solutions vary in accuracy, and fraudsters can make even the toughest technologies susceptible to spoofing attacks using advances in synthetic voice and high-resolution images and video. Overcoming these challenges has introduced a level of friction for customers that is frustrating and a deterrent to successful biometric adoption. This is the problem that ID R&D is dedicated to solving.

ID R&D is committed to creating unique, science-driven capabilities that help banks simultaneously improve the user experience and dramatically increase security in mobile and web apps.

There are many solutions in the biometrics market that claim to use advanced AI techniques – What sets ID R&D apart?

Many biometrics platforms claim to use advanced AI, but not all AI is the same. Vast differences exist in performance given the newness of the technology. For example, during the most recent ASV Anti-Spoofing Challenge in March 2019, every company competing was applying AI in some way, yet there was a wide range of results. ID R&D produced the first-place score — ahead of the second-place finisher by nearly 8x. This shows how our skill in AI sets us apart.

Our core voice biometric performance is another example, and finally our breakthrough passive facial liveness is yet a third. ID R&D is the only company in the world who has solved the problem of determining liveness from a single image with no action required by the user. Other systems require the user to smile, blink, follow a red dot on a screen with their nose, move the phone, use video, or other methods requiring active participation. None of this is necessary with ID R&D’s passive facial liveness. We applied nearly 10 man-years of effort to this problem and now have customers in production with more on the way.

The other critical point about what sets us apart is purpose. We believe that the best user experience is no user experience, meaning that authentication happens without the user required to do anything other than use an application naturally. So, we’re not using AI to do what everybody else is doing, but better. We’re using AI to create an entirely new approach to how banks authenticate users, onboard new customers and stop fraud.

ID R&D is headquartered in NY, but you recently opened an office in Silicon Valley – how do the two innovation hubs in the US compare? Why now for the expansion to the Valley?

We started out in NYC to be close to the Finance industry and the city’s large contingency of both banks and FinTech partners.

As the company expanded, we recognized there is also a large concentration of financial institutions on the West Coast and that many of our prospective customers maintain innovation labs in Silicon Valley. By establishing a technology team in Silicon Valley, we are not only close to these innovation labs, but also gain access to top technical talent as the business grows.

Having dual headquarters in Silicon Valley and NYC is the perfect marriage of “Fin” and “Tech” for ID R&D, our customers and partners.

What advice would you give new startups in this space?

We believe it is vitally important to focus on solving a problem — and to do it really well and with innovative approaches that result in true differentiation and measurable value. You can’t skimp on R&D. Know going in, that getting traction with financial institutions can take a long time because they are generally too large to move quickly. Financial institutions are making great efforts in accelerating innovation, but still face the reality of needing to involve large numbers of people to get things done.

We have an array of craft beers and independent music at FinTECHTalents – Give us a great song to listen to while we sip your favourite tipple

Oh fun! How about Judah and the Lion, Take It All Back?