Last week’s #FTT21 Fintech Talents festival didn’t disappoint on any level. A mix of incumbent bankers, industry leaders, influencers, fin-techers, sponsors and (as Fintech Talents likes to call them) “rockstar speakers” made for plenty of interesting discussions on and off the four stages.

But midway through the second day, I caught wind of a different buzz. Several people were talking about one of the festival’s five star sponsors, Mambu, calling open banking “a failure”.

I was surprised, a little annoyed, and thoroughly disappointed.

I wasn’t in the room where it happened, and I’ve now found the real statistic behind the claim –– more on that later –– but at the time, I began to question the rhetoric and portrayal of open banking.

Starling Bank’s CEO, Anne Boden has also recently commented that “open banking has not been a success”.

Mistaken identity

Has there been a misinterpretation of quotes, underlying messaging, or is there a new narrative forming?

Is a continued public bashing of open banking on the cards?

Dharmesh Mistry, CEO of AskHomey doesn’t think so. He recently wrote about Anne’s comments being misinterpreted, predicting also that, “[open banking’s] impact is a transformation on the scale of the industrial revolution, which clearly is going to take time to fully play out.”

The significant opportunities that the new “open” environment brings, keeps me positive.

Working for untied –– a fintech company that has open banking at its heart –– I’ve seen first-hand the positive impact that this technology has had for our users. Solving particular pain points. Supporting financial inclusion. Improving financial well-being.

I’m watching the evolution from open banking to open finance and I’m looking forward to open data. The story is still to fully unfold, and it could take several years, but the benefits will undoubtedly compound.

It’s far too early to call it a success or failure.

But perhaps it’s time for a rebrand.

Source: Fintech Talents

Speaking on a panel at the FTT event, I suggested we should all just stop calling it “open banking”.

I was not alone. Others were similarly talking about it at the event, on different stages, and conversations spilled out afterwards onto social media.

Does that mean we are all contributing to the failure of open banking?

No. Not at all.

The problem is not the technology, it’s the words we use to describe it.

Chris Higham, Head of Payments and Cards at Secure Trust Bank said, “we all know the effort that’s gone into security and consent, but the word ‘open’ doesn’t encompass that.”

Multinational telecoms company, BT, are three weeks into a proof of concept that allows customers to pay bills using open banking payments. Alexandra Bloomfield, BT’s Payments Industry Specialist & Open Banking lead has already observed similar sentiments: “We need to get away from using “Open Banking” as a way to describe paying by Banking app. People in the payments space know what it’s called, but consumers want a bit of a ronseal type name.”

‘Open’ and ‘banking’ used together just seem to cause worry and mistrust among consumers.

Identity crisis

So, why do we continue to use these two words in the industry?

It’s a crisis of identity for open banking.

A turning point on the ‘open’ journey, both in terms of the comments, the consumer perception and the underlying technology.

We must not lose sight of what matters to customers. They don’t care or understand the term and why do they need to? It’s for us to care –– about what the customer wants.

Will Billingsley, co-founder of ApTap agrees, writing on LinkedIn: “…who cares what we call it and who cares how it works? If it adds tangible value to the customer in a secure way, I think we’ll see adoption continue on a steep, upward trajectory.”

This is where any assertion of open banking’s failure seems to suffer its own misinterpretation.

We should be measuring the value created and the needs it fulfils. That’s what customers care more about –– not us measuring the misunderstanding of the phrase.

Looking back at the data, we can see why the definition of success and failure is not so cut and dried.

Earlier this year, Mambu published results of its global open banking consumer survey. There are some excellent findings in the report, so it’s worth a read, but one relevant statistic stood out to me which undoubtedly fuels reporting the failure:

Source: Mambu Disruption Diaries – Open Banking Report

Yes, the majority (52%) of respondents had never heard of open banking.

Of course they haven’t, and I say long may that continue. Why do they even need to hear about open banking.

And because they haven’t heard of it doesn’t make open banking a failure either.

How many individuals in the UK have heard about the BACS schemes? Yet, nine in ten UK consumers use BACs to pay their bills, probably without knowing BACS at all. They know it as Direct Debits, making over 4.5 billion Direct Debit payments a year through the scheme.

We should not measure success (or failure) on people’s knowledge of terminology, but on the solutions and value they bring.

In Mambu’s survey, Accenture’s MD of Payments, Sulabh Agarwal says, “A normal person doesn’t know or care about open banking, but if you say to them it will fill in your tax [return] based on your banking data, they’ll love it. They don’t need to know that there’s open banking behind it.”

Well, that is simply music to the ears of a Chief Product Officer who has an app that uses open banking to help fill in tax returns.

New identity

And adoption is increasing.

The Open Banking Implementation Entity’s (OBIE) reported in August 2021 that one in 13 digitally-enabled end users were using at least one open banking-enabled product or service, compared to only one in 40 in January 2020.

Consumer adoption is also about to get its own turbo charge boost, as major companies embed new payment solutions into their own journeys. It’s an opportunity to standardise terminology that consumers can embrace and understand and use when describing what they are doing.

First, let’s consider the history of contactless payments, which were magic, extraordinary payment flows when they arrived in the UK in 2007. Adoption really accelerated when Transport for London (TfL) enabled contactless payment on the tube and rail in 2014, driving over 80 million monthly London transport journeys using contactless payments by 2019. As people saw others using the payment method in front of them, they quickly became more comfortable with using contactless themselves and not just on London Underground.

We’re seeing a similar change happening with open banking payments now with embedded finance solutions.

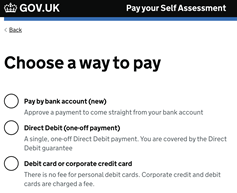

Earlier this year, HMRC introduced a new payment method using open banking rails. The process doesn’t mention open banking at all to the consumer, using ‘Pay by Bank Account’ because it “tested better than anything else in terms of understanding and trust”. The terminology is clearly helping. HMRC has already received well over £1 billion in tax payments using this method.

Source: GOV.UK website

Other companies like Cazoo (car buying) and JustGiving (charity donations) have also introduced the new payment method. Both have stayed away from the open banking terminology too, using “Bank Transfer” and “Pay with Bank Transfer“ respectively.

More embedded payment journeys like this from big household name brands, is bound to help increase adoption massively.

Nevertheless, ask any person who has used one of these journeys if they know what open banking is and I’ll bet most will give you a blank stare and a negative response.

They don’t know and they don’t care.

Open banking goes on behind the scenes. What matters to them is that it works. They get the outcome they want at the right time without needing or wanting to know what it’s called. At best, they get their job done. At worst, they become part of the statistics –– one of the 52% who have still never heard of open banking.

Tell me I’m wrong.

So is it that they really don’t know about open banking or are we just asking the wrong questions?

There is not only a huge opportunity for consumers to benefit from this new open environment, but also for both banks and fintechs to capitalise.

After Open Finance comes Open Data, with an estimated $416 billion of revenue at stake, according to Accenture, and the fast growing trend in all types of ‘open’ data capabilities presents even greater opportunities.

Image Source: Whitesight – Open Banking: A Gamechanger For The Financial Ecosystem

It’s an ecosystem that can connect, converge and mesh so many, seemingly unrelated, nodes.

Most recently, a new Open Life Data Framework was published by the All-Parliamentary Group for Longevity. Designed to enable sharing ––with consent –– of both non-health data (financial, consumer, mobility, environmental..) and health data, it promises a way to unlock innovation and increase healthy life expectancy by 5 years, while minimising health inequalities.

If someone asks me to securely share data, which could potentially help me or fellow citizens of this planet to live longer, I’d be open (sorry, pun intended) to that prospect.

This sounds like a laudable endeavour, but it too needs to apply the lessons learned from ‘open’ banking in terms of establishing its identity to ensure maximum public success.

True identity

Getting the language, branding and messaging right for open banking is critical now, as it will form a better understanding among the public when other ‘open’ initiatives like Open Finance go more mainstream too.

We can do this by showing, rather than telling, consumers about the benefits.

We can do this by putting these solutions into the hands of more people.

We can do this by educating about the value the technology brings –– in words that enhance trust and security.

Telling people about how data sharing works doesn’t give a true picture about their willingness to use open banking. In recent research from McKinsey on open financial data, they created mock-ups of multiple open banking propositions in order to gauge customer sentiment. Show, not tell. Unsurprisingly, sentiment was highly positive.

McKinsey found…“while consumers showed innate conservatism toward data sharing, their willingness to share data doubled when they found a particular feature or service appealing or when they understood the value it might bring to their lives — as compared to a general willingness to share data”.

As an industry, we have a huge opportunity to help people by providing innovative solutions using open technology. New journeys that we create will become second nature to consumers, embedding those journeys into their ways of living and working, supporting their lifestyles.

We must help shake off the misconceptions, misunderstandings and biases around open banking terminology. Mambu’s report suggests ‘smart’, ‘shared’ or ‘collaborative’ banking is better than ‘open’.

I’m all for a change.

For the benefit of all our users and customers, we must stop asking the wrong questions, and start raising awareness of the right solutions, using the right words.

Smart banking…for the win!!

Written by Paul Loberman, Chief Product Officer, untied