Gilad Amir, Operating Partner for Technology, Pollen Capital

Over the last couple of years I have been involved in several digital transformation activities as part of the Pollen Street Hub support for portfolio companies, across Lending, Payments, FX, Insurance, Wealth Management and Business Services sectors. As a PE fund we (arguably) have the privilege to be much more focused on delivery and getting things done without the bureaucracy, politics and other cultural blockers many FIs face. Therefore, I thought that our experience could provide a useful reference as to what’s actually happening in the digital transformation trenches.

Giving your customer an umbrella when it rains

Financial services, as many other industries, are changing at an unprecedented pace, with a stronger focus on customer centricity and erosion of transactional business models. While there are different drivers to those tectonic changes, these come down to the confluence of two mega factors:

- Clear shift from utility to distribution and customer ownership — this is truer than ever in the post CV19 world, where customers choose brands that manifest empathy, deeper understanding of the customer and real value exchange.

- Tech commoditisation — technologies become increasingly cheaper, more reliable, easier to adopt/ change, and generate faster/ higher return on investment.

The direct and immediate impact of these two factors is a 180 degrees turn in the way financial service providers think about products and customers — i.e., starting with customer needs and walking backward. By way of example, giving a mortgage is different from helping a customer buying a house. Very different. And requires seeing the customer and assess the business proposition through a different lens. It also requires a significantly different mindset and set of capabilities in the business.

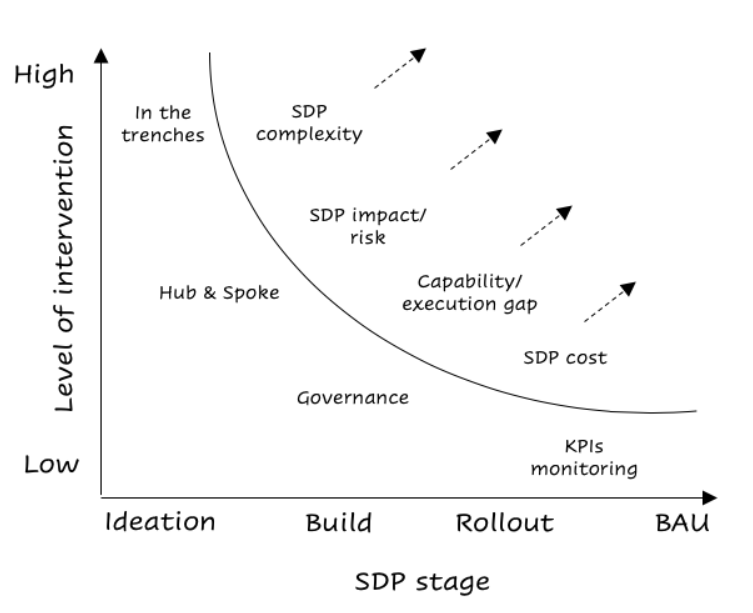

As a sector specialist, we see and experience those changes on a daily basis. Beyond the challenges and risk, we see a strategic opportunity to transform and grow businesses that are smarter, better aligned with customers best interest, and ultimately more sustainable. That required us to develop a new set of capabilities and disciplines across the fund, that would allow us to systematically transform and support the businesses we buy and create higher value via strategic digitisation programs (SDP) and intervention model, as illustrated in the following diagram:

CEOs, and all the rest

CEOs, and all the rest

Digital transformation is similar to replacing a propeller engine with a jet engine while flying at 40,000 Feet. As a ‘business rewiring’ process that crystallises the What, and challenges every possible aspect of the How, success is mostly dependent on the business’ ability to adjust and change. And this can happen only if it comes from the top, or more precisely, from the CEO.

Digital transformation spans the whole organisation. Having established it, CEOs need to ensure they keep themselves and their executive team surgically aligned on the end vision. Competing priorities, internal politics and the day to day background noise that all executives deal with can easily derail a complex transformation. In a regulatory-driven industry, which DNA is programmed to play safe and “not break anything”, digital transformation and (post transformation, on a BAU basis) a “change is the only constant” mindset are both significantly more challenging to execute than in other industries.

Simply put, the binary variable to digital transformation is the CEO. Not CTOs, CIOs or CDOs. CEOs. CEOs with the right vision and commitment/ ability to lead, drive and empower change will make it happen. The rest won’t. Moreover — CEOs should draw the digital vision with the support of the Board, and let the CT/I/DOs build. It doesn’t require a PhD in rocket science, but rather to understand what technology can do, its impact on production, and the role it plays in the way customers consume products and services, and how they engage with the business.

Soul searching

Digital transformation is a refinement process, and some would argue a soul-searching exercise, the ultimate goal/ outcome of which would be to properly identify, and then digitally empower the business’ value-add, and automate all the rest. Simply put, it’s an exercise that requires the business to challenge core assumptions/ beliefs about its right to exist, rethink and (re)position its place in the (digital) value chain — and doing so by answering two principle questions:

What does the business really do (some would call it the Why/ Purpose)? and in more detail:

- What is the unique value to customers? and based on which distinct capabilities/ assets?

- Does technology change the answer to this question? Interestingly, the right answer to the above question must be tech agnostic — i.e., if technology significantly changes the answer, it’s the wrong answer.

This is the most fundamental question and should be used as the north star throughout any transformation. Failing to ask this question, or not answering it properly, is one certain way to derail a business and erode value.

How does the digital…

- Production model work? How can tech augment the business’ value drivers (and allow employees to focus on high value tasks), and automate/ outsource/ eliminate all the rest?

- Delivery/ Distribution model(s) work? How do customers digitally consume the products?

Real disruption is doing the same thing, better. One of the biggest mistakes businesses do when facing disruption/ change (aren’t we all?), is to confuse the What with the How — i.e., holding onto existing methods of doing business, rather than focusing on customer needs and market dynamics, and constantly challenge and evolve the production and distribution capabilities/ methods around them.

Talking business

Talking business

The purpose of technology is to serve the business. Again, the purpose of technology is to serve the business. As obvious as it may sound, the reality and gaps between the technology change requests/ programs/ spend, to the business strategy and objectives, teach us that it’s not as trivial as one may think. Not trivial at all.

Businesswise, a digital transformation process should achieve one or more of the following business objectives:

Revenue increase/defence — primarily by improving the overall customer experience (CX) throughout the product/ customer life cycle, and making better use of data (not AI!, data). This in turn will drive:

- Increased customer satisfaction, loyalty and ultimately LTV

- Better understanding of cross/ up-sell opportunities

- Better customer profiling/ segmentation and personalisation

Higher profitability due to increased efficiency — process streamlining/ optimisation, automated data capturing and making better use of data, allowing the business to:

- Reduce the number/ cost of employees who perform low value tasks

- Address higher business volumes with the same number of employees

- Reduce risks and associated costs

Scalability — the ability to do much more with the same set of resources, due to increased productivity. By automating the low value tasks and freeing up employees (across the business), these employees can meet a significantly higher business volume. In addition, in many areas, digitisation turns the ‘dark art’ into science and can extend know-how and expertise faster and more systematically

Risk reduction — digital businesses create digital footprints and data, which allow much higher transparency, governance, and management of the variety of risks FIs are exposed to, including:

- operational risks

- internal/ external fraud

- credit risk and collections

- compliance risks — conduct, regulatory reporting, KYC and AML, etc.

- cybersecurity

Therefore, any transformation activity/ tech build should be directly correlated to and measured against one (or more) of these four objectives.

Moreover, the alignment of tech build/ rollout to these business objectives should be monitored via KPIs that measure the business deliverables/ outcomes. These KPIs allow decision makers to understand the trajectory/ magnitude of value creation/ risks, and in addition should be used as a common language and point of reference across the business.

Getting a bit technical

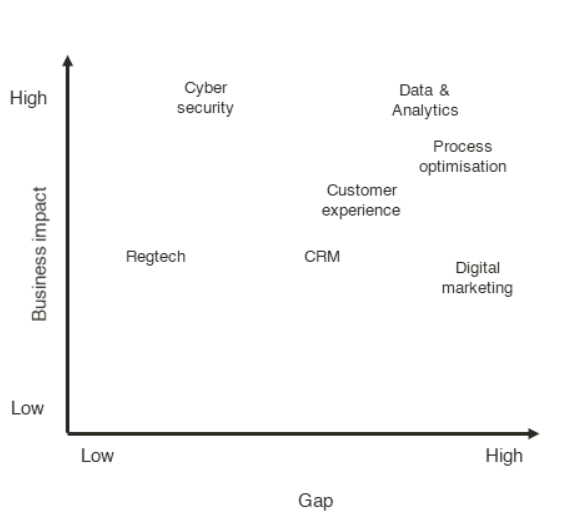

The following heatmap illustrates the typical state of digital gaps/ needs (business impact) we see at the beginning of the transformation process:

This diagram captures the output of the framework we use at Pollen Street Capital to assess the business impact of different technological capabilities (at the business and business unit level), and the gaps in each. This framework is vendor-agnostic, and allows us to make an unbiased gaps-needs assessment. In turn, it underpins a more strategic approach to prioritisation and resource allocation, with a higher correlation between technology build and business outcomes, and ultimately more measurable ROI.

This diagram captures the output of the framework we use at Pollen Street Capital to assess the business impact of different technological capabilities (at the business and business unit level), and the gaps in each. This framework is vendor-agnostic, and allows us to make an unbiased gaps-needs assessment. In turn, it underpins a more strategic approach to prioritisation and resource allocation, with a higher correlation between technology build and business outcomes, and ultimately more measurable ROI.

I’ve set out some considerations as relate to key items on the above heatmap:

The overlooked Business Process Re-engineering/ Optimisation

Business process re-engineering is the process of switching the analogue business engine with a digital one. It essentially means rewiring the operating model to allow employees to focus on higher value tasks (whilst automating all the rest), and drive scale exponentially. While constantly overlooked (or wrongly executed by ‘digitally mirroring’ the existing/ analogue business), it’s the foundation of digital transformation, which if done properly, will become a key enabler to new business models and digital strategies.

AI illusions and the state of data affairs

Proper use of data and analytics is one of the two biggest opportunities in digital transformation. We, as many others in the industry, often hear about AI and its promises. The reality is that the real value lies in building and maintaining the business’ data assets and overlaying the right analytical tools. Proper data maintenance and enrichment, coupled with good analytical tools would unveil 80%-90% of the insights/ trends. AI is the cherry on top, and adds the last 5%-10%, assuming the data was enriched to the point AI could be properly applied.

The over-hyped CX

Customer experience (CX) is the cumulative sum of experiences and interactions customers have with a certain business, and/ or the result of customer outcomes at the point of need. CX is clearly important, yet secondary as it relies on a solid digital foundation, and surprisingly less significant than one may think (or often be pitched to as the ultimate cure to disruption/ technological gaps). That said, interestingly CX is often interpreted as user interface (UI). CX is not UI. UI is only one dimension that may support better CX, or not.

Vendor selection

The quality and maturity of technologies in recent years have led to a clear shift from the ‘all singing all dancing’ technology platforms (which other than locking businesses in long-term expensive contracts, usually do neither), to a best-of-breed approach. This approach allows the use of the best vendor for each component/ category (coupled with the right orchestration tools), and a much more modular/ flexible/ adaptable architecture.

MVP, Agile, Lean, Scrum and other diets

Going digital involves taking risks. Doing business involves taking risks. Same as crossing the road. And yet we still take these risks, every day, responsibly. The same applies to technology build and digitisation. While tech build and rollout plans should optimise the ratio between business impact (and value of learning) to implementation risks, the use of Agile in digital transformation can lead to poor results. The more fundamental building blocks have higher levels of certainty, and therefore should be executed by using the right change methods. In parallel, the delivery/ change plan should include quick wins — even if in some cases it means using interim solutions and workarounds, that will let the business reap the benefits, accumulate experience and adjust to change more gradually.

Culture — the X factor

Ultimately, digital transformation is first and foremost about people. Whilst in most cases the technology build/ change is straight-forward, one cannot over-estimate the challenges around embedding the right “change in the only constant” culture, and supporting people through any upskilling and adopting new mental models. This is particularly true in financial services, and that where the opportunity is.

Culture is the make or break in digital transformation success and sustainability, and the ultimate expression of the CEO’s ability to drive change.

Is there a silver bullet to drive culture change? Probably not. But with the right CEO, and sufficient attention and resource allocation to culture, training and change management, it’s doable.

Gilad Amir, Operating Partner for Technology, Pollen Capital