Open banking empowers organisations and individuals to untap data, improving accessibility and allowing organisations to provide better products and services for customers. It encourages personalised products and a more engaging customer experience, something customers now demand as digital transformation has accelerated throughout the pandemic.

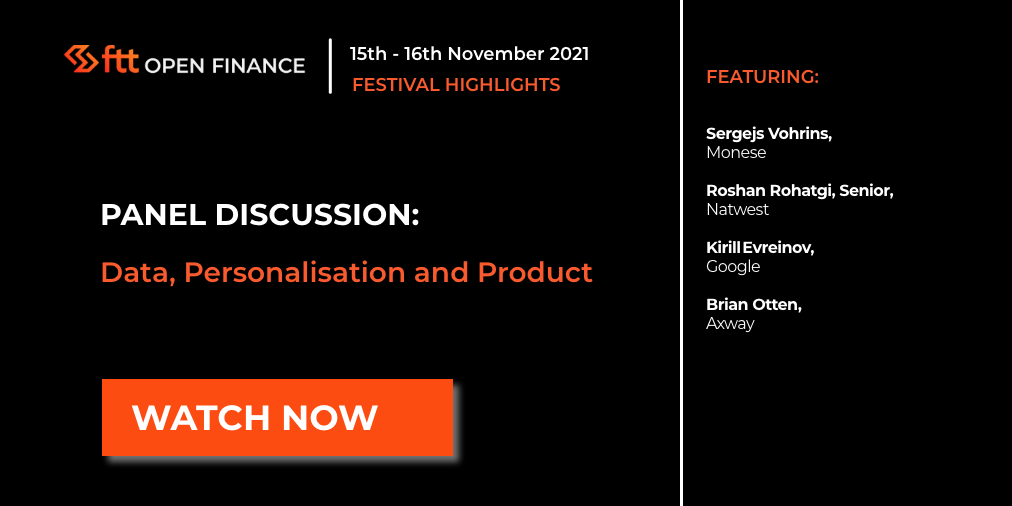

On the FTT Open Finance Stage at our FTT Festival in November 2021, we explored the importance of personalisation, different data management strategies, and some of the challenges that come with open banking.

The panel – Data, Personalisation and Product, was moderated by Brian Otten, Digital Transformation Catalyst – Digital & API Strategy of Axway. There was a strong emphasis on taking a customer-centric approach to open banking, ensuring that data is always utilised for the benefit of the consumer.

A key challenge for incumbent banks when trying to unlock this data relates to outdated legacy systems, as well as the complexities that come with multiple mergers and acquisitions. Many institutions will need to update systems to become more agile to accelerate the delivery of services, so they can remain relevant in the competitive market.

Organisations also need to embrace the new world and start to think differently about service delivery. This change management process should come from leadership, but teams also need to gain a better understanding of technologies and how they can be utilised. There is a necessity for agile technology systems, but also for breaking down silos within teams to create a more agile workforce.

There is another challenge; open banking solutions need to keep up with real-time data to ensure the most accurate and suitable products are provided to customers. Roshan Rohatgi of NatWest emphasised that the most important thing institutions can do is understand a customer’s personal situation and the life moments that are most important to them.

Third parties can help banks access this real-time data, to provide empathetic solutions that are ethical and deliver best-in-class products to the bank’s customers. Partnerships are important because third parties can provide a framework which is cost-efficient and works with streaming data. The process must also be secure and adhere to all the standards that banks face.

The panel place a great importance on the collaborative effort in building open finance propositions. They also outlined the benefits and open banking use cases outside of financial services. Unfortunately, one of our panellists, Maria Papdelli of YuLife was not able to join on the day, but Brian pointed to how YuLife are utilising open banking in the mental health and wellness space.

In addition, the other panellists looked at how open banking has made data more accessible to individuals, so they can further understand their impact on the environment and how to hit ESG goals. There was a strong agreement that the benefits of open banking apply to wider society and that perhaps, they had not been fully realised yet.

Although many institutions face challenges in adopting open banking, the benefits cannot be ignored. Open banking is crucial in meeting the changing expectations of customers who demand a more personalised and streamline experience. You can listen to the full recording of this panel below.

The Panel:

Brian Otten, Digital Transformation Catalyst – Digital & API Strategy, Axway (moderator)

Sergejs Vohrins, Product Lead – Open Banking, Monese

Roshan Rohatgi, Senior Innovation Scout, Innovation & Solutions, NatWest

Kirill Evreinov, Solutions Engineer, Google Cloud