After the festive break, we are delighted to be getting back to all things fintech innovation – and what better way to start the year than with FTT Lending 3.0!

On 30th March, our community of financial institutions, alternative lenders, fintechs and technology providers will come together at the ETC Venue, St Pauls. The 2022 agenda will tackle strategies for leveraging the latest innovations in the lending space to serve the rising generation of borrowers.

We will explore innovation within consumer, mortgage, SME, specialist and P2P lending to name a few, but also consider some of the emerging lending types that are disrupting the sector. This week, the spotlight is on the much-anticipated panel – SME lending gets a makeover.

In response to Covid-19, SME lending has become one of the most crucial areas of lending for economic recovery and business survival. As of July 2021, government backed business loans had reached £80 billion since the beginning of the pandemic.

As traditional banks and alternative lenders continue to support SMEs moving forward, and the governments reduces their loan support, competition is becoming fierce. Changes in customer expectations due to the relevance of technology in everyday life has also transformed the market significantly.

SME lenders need to adapt their customer experience and products to fit with a new generation of borrowers – the generation of Netflix, Amazon and BNPL. In its bid to catch up with consumer lending in terms of customer experience, decision making and inclusivity, SME lenders need to be agile and adopt new technologies. But how exactly can lenders transform their products to provide best-in-class SME lending capabilities, to match the needs of 21st century borrowers?

Open banking has had a significant impact on SME lending in recent years; it has allowed SMEs to benefit from digital payments and business accounts in the same way that personal accounts allow for. Automated information gathering, real-time decisions, personalised products and engagement – these have all been enabled through the implementation of open banking.

As highlighted by Julie Ashmore of NatWest Rapid Cash during the FTT Festival in 2020, “time is money to SMEs”. SMEs expect quick decisions to be made and cash to be in their accounts within minutes.

During the panel – Open for business: innovation in SME finance, Simon Cureton of Funding Options reflected on the importance of personalisation in SME lending, emphasising that, “it’s not one size fits all”, and businesses do not always understand their funding options. Businesses have unique needs so multiple data points are crucial in matching SMEs with lending products.

The SME landscape is challenging but there’s space for innovation and progress. The reward for adopting new technologies such as AI, open banking, blockchain, big data, and digital platforms to support SMEs in achieving their goals will be transformational.

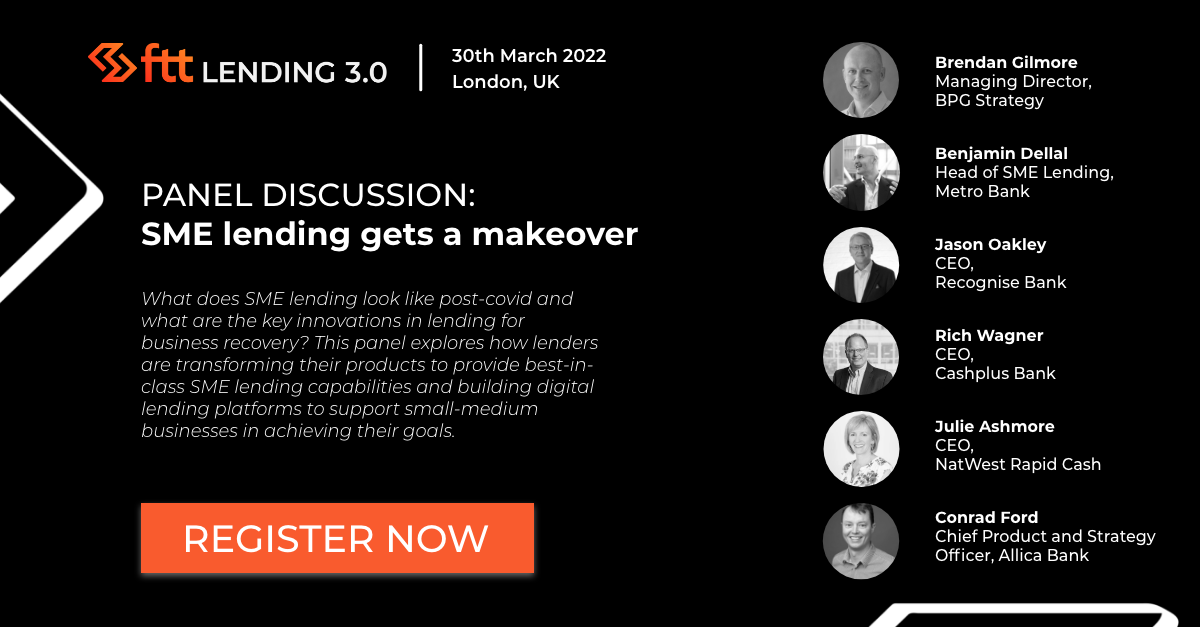

We will continue this discussion on 30th March at FTT Lending. The panel, SME lending gets a makeover, will be facilitated by our rockstar moderator, Brendan Gilmore, Managing Director, BPG Strategy. We hear more from Brendan on what he is looking forward to exploring in the panel:

“Innovation in SME Lending was already happening before the pandemic, but SMEs’ transition to working digitally and trading online during the Covid lockdowns opened their eyes to new and different ways of doing everything, including borrowing and hence the environment is ripe for those who can provide funding simply and rapidly.

I’m really looking forward to hearing from this excellent panel on the opportunities and challenges the new reality has presented them.”

We are also delighted to be joined by our rockstar panellists:

- Benjamin Dellal, Head of SME Lending, Metro Bank

- Jason Oakley, CEO, Recognise Bank

- Rich Wagner, CEO, Cashplus Bank

- Julie Ashmore, CEO, NatWest Rapid Cash

- Conrad Ford, Chief Product and Strategy Officer, Allica Bank

We look forward to continuing this discussion with Brendan and the panellists at FTT Lending 3.0 on 30th March, where we will explore digital transformation and the SME lending makeover. Register now for your pass!