Questions around culture, human resources, regulations, compliance, the impact on society and the environment are often overlooked by companies that strive for huge amounts of growth. This industry is now looking at prioritising factors beyond financial metrics, market-fit projections and customer acquisition numbers.

Have environmental, social or corporate governance factors moved on from a ‘nice to have’ to a ‘need to have’ in 2020?

This was the question we asked our community last week. This week – we have our answers.

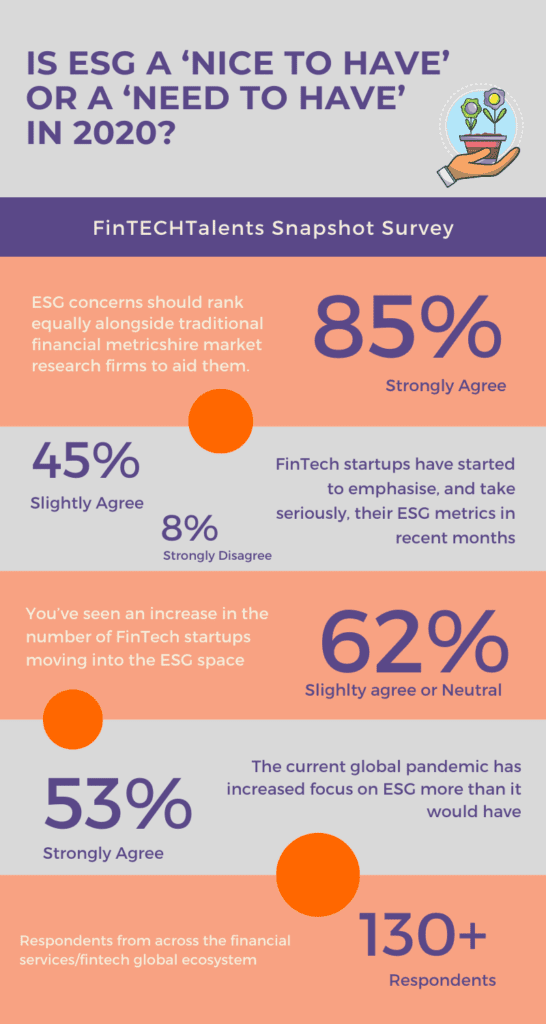

Most of our community agrees (at various levels) that ESG concerns should rank equally alongside traditional financial metrics. Agreement was also found when asked whether the current global pandemic had increased interest in ESG among companies. However, that is where the hope ends. Most are less sure that they have seen an increase in start-ups either taking ESG seriously or new start-ups moving into the ESG space.

While hope remains that many in our industry will start to take ESG concerns more seriously, we have yet to see any concrete action towards those goals.

Here are your community results:

ESG concerns should rank equally alongside traditional financial metrics?

- 85% Strongly Agree

- 15% Slightly Agree

FinTech start-ups have started to emphasise, and take seriously, their ESG metrics in recent months?

- 8% Strongly Agree

- 45% Slightly Agree

- 39% Neutral

- 8% Strongly Disagree

You’ve seen an increase in the number of FinTech start-ups moving into the ESG space?

- 23% Strongly Agree

- 31% Slightly Agree

- 31% Neutral

- 15% Slightly Disagree

The current global pandemic has increased focus on ESG more than it would have?

- 53% Strongly Agree

- 31% Slightly Agree

- 8% Neutral

- 8% Strongly Disagree