Embedded finance: Where should digital platforms look next to help small business owners?

Digital platforms have changed the way entrepreneurs think about starting a business. The shift over the last decade from brick-and-mortar to online, and from online to marketplaces and platforms, has made it increasingly easier for small business owners to get started and to reach customers.

A combination of external factors in recent years, catalysed by the pandemic, has fuelled a shift in working patterns from the more traditional single employer into more flexible, independent freelance work.

Whether a shift out of choice to create additional income to keep pace with increased costs of living, wanting a better lifestyle, or through necessity due to furlough and redundancy, 15% of working adults now get paid via digital platforms serving the independent ‘gig-economy’. That figure has tripled in the last five years, as short-term, flexible, freelance ‘gigs’ replace the Monday to Friday 9-5 office job.

One particular segment of independent work that is booming is the creator economy. The rest of this piece can just as much relate to any micro business, solopreneur, sole trader, gig worker, etc…but let’s focus on this particular market as the stats alone here indicate it’s time to take notice of these small businesses.

- Over 50 million creators

- Venture funding exceeded $3.7 billion in 2021

- The market is worth more than $100 billion.

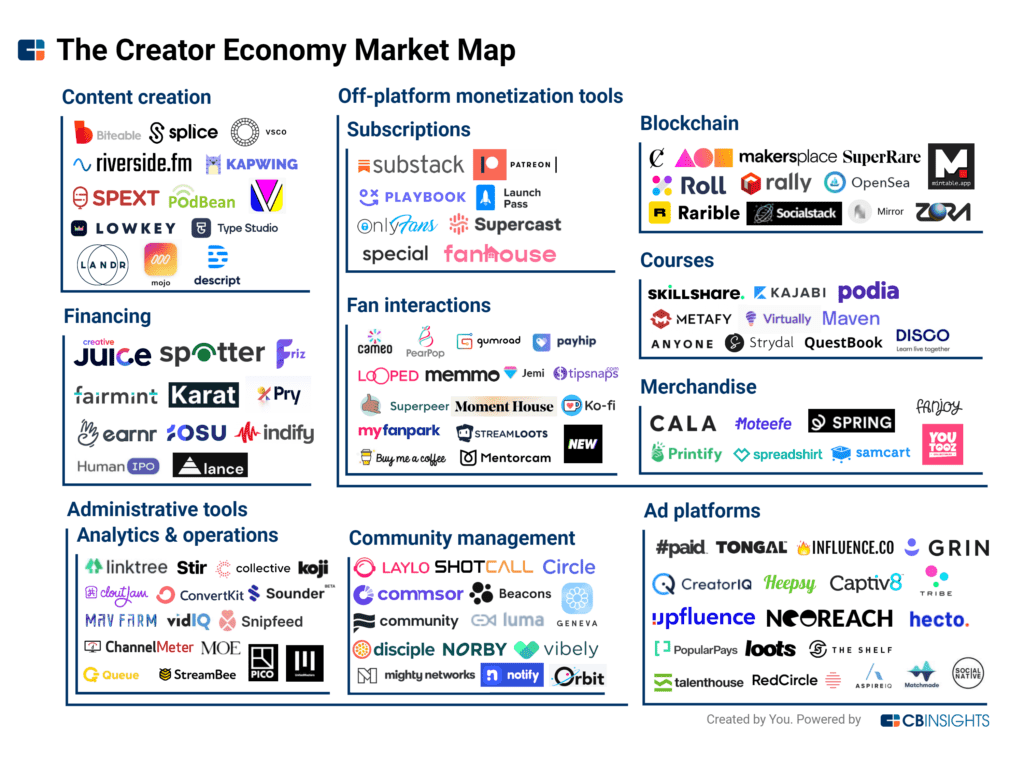

Digital platforms like Etsy, Fiverr, and Shopify, along with social media platforms like YouTube, Instagram and TikTok, have all made it possible for anyone to launch, grow and monetise a business as a freelance creator.

CB Insights – The Creator Economy Market Map

The ins and outs of running a business

Primarily designed around content creation — connecting creative freelancers with customers — the platforms servicing the creator economy are expanding rapidly to provide more tools to creators, and some focus specifically on a creator vertical like writers, designers, gamers, musicians …

But, are digital platforms ready to solve every problem for these small business owners?

With knowledge about their craft and a passion for their audience, many creators don’t necessarily have the skills or knowledge for how to run their passion, as a business — they just know they want to get started and to focus on their creativity.

Like all small business owners, independent creators need help with five core “jobs to be done”:

- Help me get paid

- Help me control my costs

- Help me manage my cash flow

- Help me manage my financial admin

- Help me stay compliant with tax, legal, regulatory obligations

Small business owners imagine their lives being better when they have the right solutions to their problems. These jobs are not the easiest to tackle when you’re a solopreneur. Without any employees to share this work, they’re left to their own devices and will often look for support from somewhere else to help get these jobs done.

These are all areas of opportunity for digital platforms — helping to take away the stress of managing day-to-day finances, administration and operational activities.

Embedded finance solutions

The rise of embedded finance, driven by the rapid increase in flexible fintech solutions and Banking-as-a-Service (BaaS) providers such as Mambu, Railsbank and 10X Banking, have made providing support easier than ever. Platforms can now expand their range of financial products and services simply, efficiently, and profitably, through strategic partnerships, providing the right solutions at the right time for entrepreneurs.

Offering additional services also creates attractive new revenue streams, helping platforms to diversify business models, and to support both sides of their platform network.

Those platforms that have successful and proven embedded finance propositions can go even further, repackaging these as their own B2B solutions to offer to new partners in what can be a new platform to platform model.

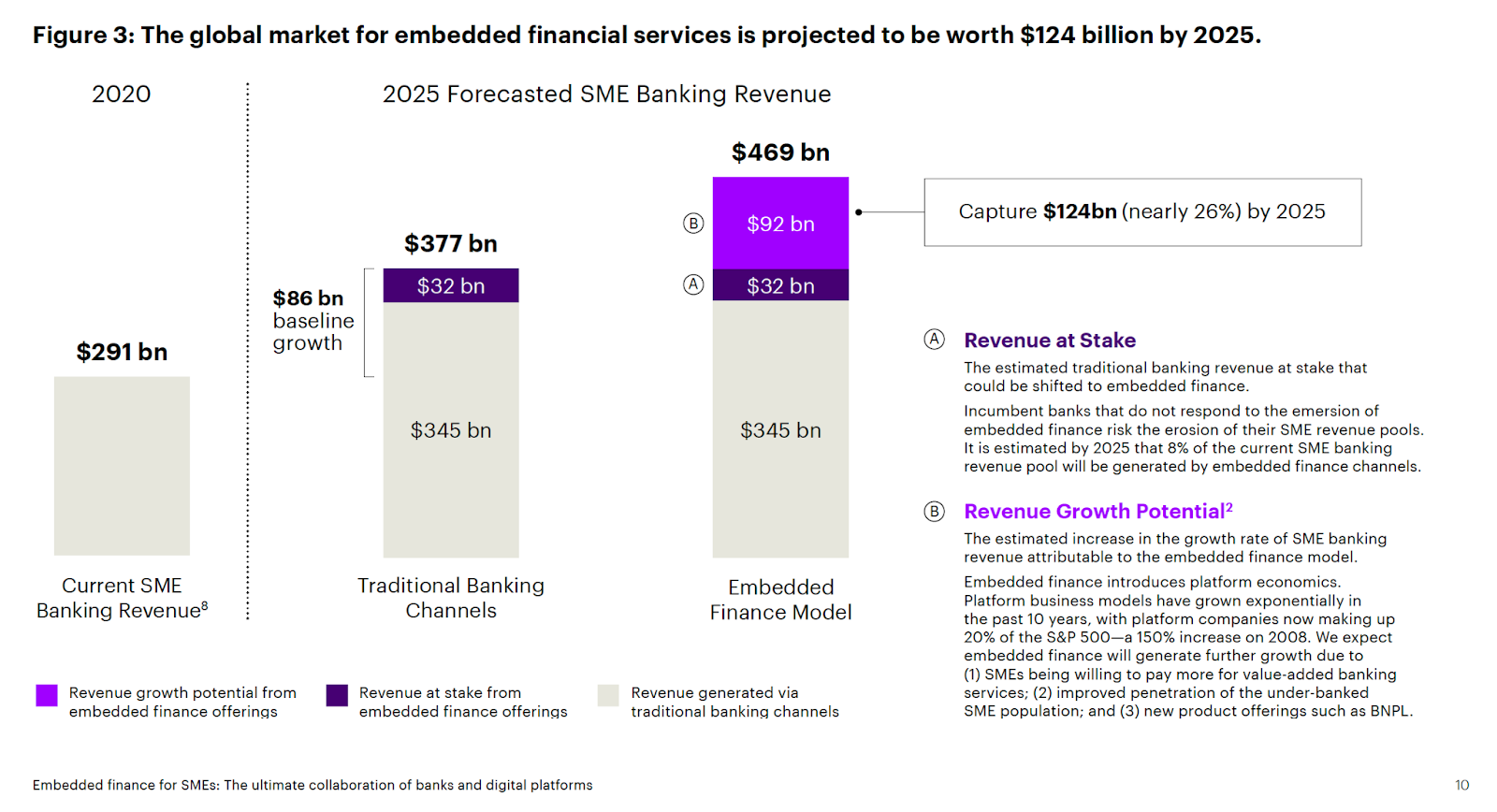

The opportunity is significant. Accenture* forecasts a revenue uplift of $92 billion from embedded financial services capturing 26% of the global SME banking market (a value of $124 billion) by 2025.

Accenture Report – Embedded Finance for SMEs: Banks and Digital Platforms

Expanding the platform offering

Embedded payments and banking seem to always be the products that come first. They’re obvious choices that have broad scope.

We’re seeing some early signs of a shift towards offering more financial services too, such as lending or insurance; some are even branching out into other asset classes, including crypto.

But the view here is perhaps too often taken with a traditional financial services lens.

Look back at those ‘jobs to be done’ and we see banks, fintechs and BaaS providers generally focusing support on just the first three “jobs” – payments, cost savings and cash flow.

Platforms could therefore be missing out on additional opportunities to inclusively support their users with all their needs.

So, what’s the next logical step for embedded finance solutions to help address those needs? Where are the opportunities for platforms to get ahead of the competition?

A missed opportunity

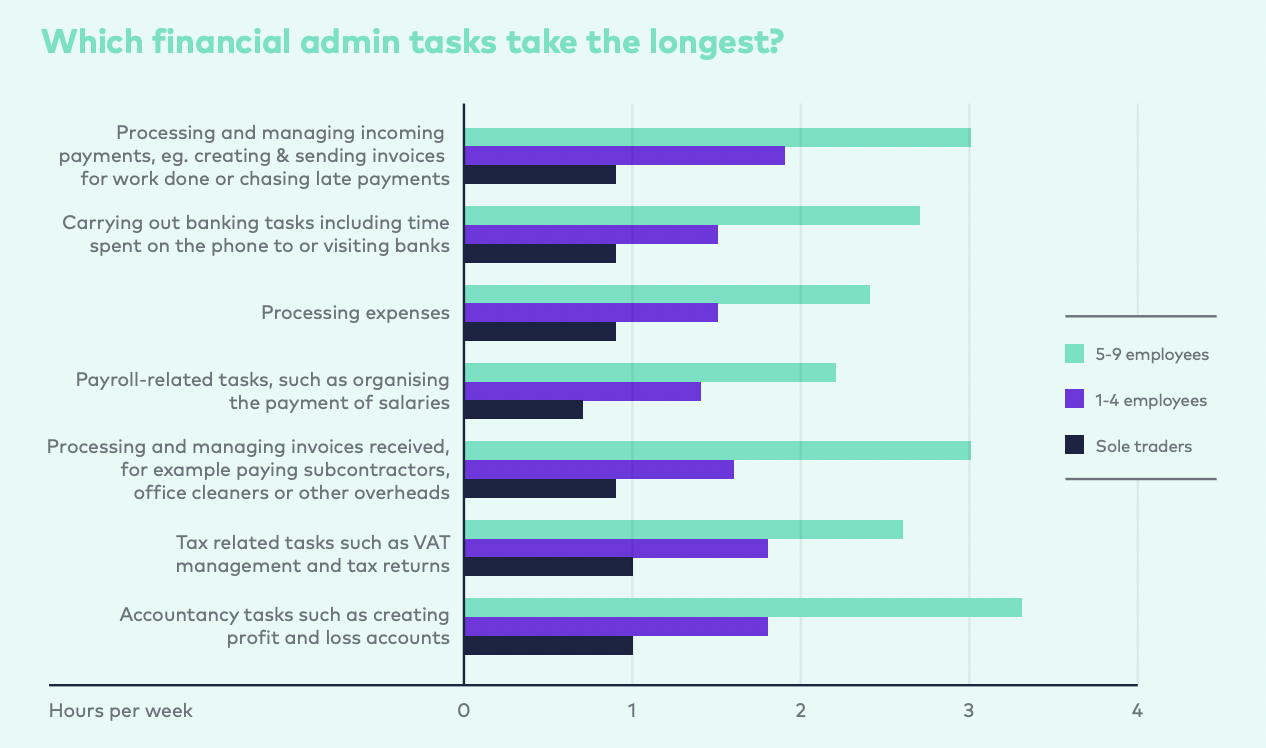

Starling Bank’s Make Business Simple Report 2020 found that sole traders spend almost a third (31%) of their time — that’s four months of the year! — on financial admin.

Tax and accounting related tasks take the longest for sole traders. 59% are not confident that they spend the right amount of time on it and one in four (27%) think it takes them far too long.

Make Business Simple Report 2020: Starling Bank

Coupled with the worry and stress of doing financial admin and getting it right, the reality for most is that they just don’t want to deal with the financial admin and compliance involved in running their business. And for many, they just don’t know how.

It’s a significant problem for independent creators, gig workers, or indeed any micro-business owner.

They need help and support to take that stress away.

This is a largely untapped opportunity for digital platforms to address through new embedded finance revenue streams if tackled in the right way.

And the opportunity is not just one of solving a real problem. It’s one that has scale too.

In April 2024, tax reforms called Making Tax Digital for Income Tax Self-Assessment (MTD ITSA) are coming into force. It’s the biggest change to the UK tax system in a generation, impacting about four million self-employed people (and property landlords) — requiring them to keep digital records and file quarterly submissions in-year, instead of an annual tax return nine months after the tax year end.

Creators will be looking for tools and software to meet their obligations under these new tax changes. According to the government’s small business survey published in August 2021, only 26% of micro businesses (with no employees) are using record keeping software for income tax self-assessment (compared with 53% of those with employees). 55% are still keeping paper-based records.

That’s millions of people who worry and stress about financial admin, need support, and will be looking for solutions to make the move to digital record keeping.

The right tools for the job

Linking into cloud based accounting systems may seem like a simple and obvious solution to the tax and accounting admin burden, but platforms should ensure these are the right tools for their specific audience. Many cloud accounting systems have been designed first and foremost for limited companies and company tax returns, not for solopreneurs.

Encouraging creators into using over-complicated tools, or worse, finding that they then must pay for costly accountants on top of new software, may not drive the best outcomes for creators, or the platforms they use.

Self-employed digital platform workers shouldn’t need to know details of double-entry bookkeeping, accruals, or accounting periods. They want something relatively straightforward and made as simple as reading their bank statement.

When it comes to their income tax self-assessment related activities, creators need something designed more around them when they’re also likely to be the sole person doing all those tasks.

Creators require a solution that’s straightforward to use and something that takes care of everything they need for their personal taxes – gathering and making sense of transactional data, tax return filings and tax payments – and which links to how and where they earn.

Every creator, sole trader and individual is different, so another important factor is finding partners who can offer a range of tax and bookkeeping integration solutions for fintechs, digital platforms, and banking partners.

There are three potential options to offer embedded finance solutions that tackle financial admin:

- Direct referral to a specialist app

- Act as a connection portal to securely exchange data with specialist third parties

- Offer platform-branded financial products and services via API

As platforms explore what’s next to offer in embedded finance services, it’s clear that removing the biggest time suck of financial admin helps small businesses grow faster, and enables business owners to spend more time in their business rather than on their business.

Let’s be creative for the creators, and build the embedded financial services capabilities that set them free to focus, not on their financial admin, but on what they’re really passionate about.

Paul Loberman

Chief Product Officer, untied – the UK’s personal tax app

untied is a platform designed specifically for self-assessment tax returns — not company tax returns — helping people do the filings that are essential to them, in ways that they understand, and removing the stress and worry of financial admin. untied is FCA regulated and recognised by HMRC for Making Tax Digital for Income Tax Self-Assessment (MTD ITSA).

*Accenture is a partner of untied through the Fintech Innovation Lab

References and further reading

Small Business Survey 2020 (Department for Business, Energy & Industrial Strategy) – https://www.gov.uk/government/statistics/small-business-survey-2020-businesses-with-no-employees

Starling Bank – Make Business Simple Report – https://www.starlingbank.com/docs/reports-research/MakeBusinessSimpleReport.pdf

Accenture – Embedded Finance for SMEs: Banks and Digital Platforms – https://www.accenture.com/us-en/insights/banking/embedded-finance-smes

CB Insights – Creator Economy Market Map – https://www.cbinsights.com/research/creator-economy-market-map/

Gig economy workforce hits 4.5m in England and Wales – Financial Times – https://www.ft.com/content/0db4979c-df93-434c-b931-77179ed5cc99

Influencer Marketing Hub – Creator Earnings: Benchmark Report 2021

https://influencermarketinghub.com/creator-earnings-benchmark-report/

SignalFire’s Creator Economy Market Map – https://signalfire.com/blog/creator-economy/

The opportunities are both exciting and considerable. We will continue this discussion at FTT Embedded Finance & Super Apps on 26th April, London, where we explore how retailers (and other non-financial brands) can introduce financial services in their digital ecosystem. Register now to join our community as we explore the key trends, technologies and innovations that are driving embedded finance & super apps in 2022 and beyond.