The small and midsized enterprises (SME) segment accounts for 99% of businesses, 60% of all private sector employment and 52% of all private sector turnover, yet, this segment has been traditionally underserved and neglected by banks. As a result, and similarly to other underserved verticals, the fintech industry has been showing increasing focus on building new propositions for SMEs, in an attempt to tap into this immense market.

I have spent a good part of my adult life building cashflow forecasting algorithms, collections management systems, SME credit scoring and digital underwriting models, during which I often heard (and still hear) the statement: “…cashflow is the lifeblood of small businesses and the number one reason for small business failure”. Right? No. Mostly Wrong. Cashflow is not the cause but the symptom. Poor cashflow is nothing but an (important, yet only an) indicator of emerging business failure, and the result of an actual one.

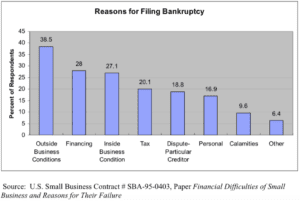

The following chart illustrates the key reasons for SME failures:

The research’s findings match other studies on the topic, and clearly dispel cashflow as a root cause of failure. Moreover, a quick look at the publicly available literature would reveal that two of the more statistically significant parameters in SME credit scoring models [1. Tangible Working Capital divided by (/) Tangible Net Assets (shareholders equity), and 2. Return on Assets minus (-) Average Cost of Debt] are not related to cashflow.

Then if cashflow is only a symptom, what are the possible causes and drivers of financial health?

I would like to try and unpick the root causes/ drivers of poor cashflow and share with SME owners some practical tips for improving the overall financial health of their business and ultimately cashflow:

Cashflow is the gauge for your business’ financial health — forecasting and actively managing cashflow improves liquidity, reduces interest expense, enables notifications to credit providers of expected cash shortages. A healthy business should generate healthy cashflow. Similarly, cashflow challenges can be an important signal of evolving financial/ business health issues.

Practical tips:

- Drive your business with the lights on and eyes open — instil cashflow forecasting as a core and continuous process in your business.

- A good cashflow forecast is actionable and presents the possible actions to improve cashflow — e.g., chase invoices, defer payments, etc.

- Simplify your cashflow monitoring and identify potential cash shortages by concentrating your payments to 1–2 fixed dates a month, and focus your collections and other cashflow decisions on getting the next important date over the line.

- Sales and collections are the most important cashflow drivers — understand your customers’ cash cycle, seasonality and other factors that may impact their purchase and payments patterns.

- A proper cashflow management process includes a rolling forecast for a time period of 1–8 weeks, and should be completed on a daily-weekly basis, as per the specific needs of the business.

- While some software tools may automate the basics, you‘ll need to get your hands dirty, understand the numbers and use your own judgement for the most reliable outcome.

Profitability is the primary cashflow engine — and accordingly, poor cashflow is in many cases the direct result of a business losing money. Hence, proper pricing and profitability analysis are two fundamental business activities.

Practical tips:

- Be sure you are actually profitable, and use professional advice/ resources to check.

- Check yourself quarterly by subtracting the total cost of salaries and monthly loan repayments from your VAT position (reported to HMRC*) — if the result is negative, get your accountant involved immediately.

- Profitability analysis should include the single product level, as well as core activities analysis (e.g., per-store/ per line of products/ per region/ overall business activity).

- Allocating costs while analysing profitability is a complex task. Ask yourself “if I were to stop selling this product/ close this activity, which indirect costs/ overheads would actually be eliminated or reduced?” and allocate the costs accordingly.

- Sales excluding VAT (boxes 6 and 8), less purchases excluding VAT (boxes 7 and 9)

Receivables and Collections Management (RCM) turns your sales and profits into cash — most SME owners hear the word collections, and translate it to invoice chasing. That’s NOT collections, that’s survival… by collections I mean instilling a core process across the business that begins at the same moment an invoice was sent to customer, and ends when a transfer hits your bank account. Such a process should define who in the business, is doing which collection activity, based on which trigger events.

Practical tips:

- Invoicing customers is an interim step — the sale is completed only when you have the money in your bank account.

- Bill/ invoice on time, and accurately.

- Once an invoice has been sent, verify it’s been received.

- Different types of customers pay late for different reasons. Understand your customers’ payment process and proactively manage it, A to Z

For a great article on the topic can be found here.

Your customers’ credit risk can translate into life or death — credit risk can be defined as the risk that one or more of your major customers will go bankrupt and not pay their outstanding debt. Such a risk may turn into a catastrophic event in small businesses, in particular if highly leveraged and/ or having insufficient net assets (shareholders equity) to absorb the shock. Credit risk management, like any other risk management, includes the following options: i. Loss Control — taking different actions to reduce the: a. probability of the risk, b. exposure — amount of loss, given default (i.e., customer bankruptcy), ii. Loss Absorption — keeping sufficient reserves as a buffer, and iii. Loss Transfer — transferring the risk to a third party through the sale of debt/ credit insurance. In most cases the decision about the preferred option should be done by professional advisers.

Practical tips:

- There’re many different early signs for customers in trouble — know your customers, and monitor their risk as a core an ongoing process.

- Have a clear plan for a material customer’s failure.

Inventory, the number 1 ‘cash drainer’ — while inventory levels’ increase doesn’t affect profitability (accounting wise), it has direct negative impact on cashflow — in simple terms, every £1 worth of excessive inventory equals £1 negative cashflow.

Practical tips:

- Factor inventory mobilisation time into your vendors’ selection criteria.

- Out-of-ordinary inventory purchases should be coupled with special credit terms and take cashflow constraints into account.

- Use consultants to analyse and optimise your inventory levels

Vendors are equally important as banks — vendors are typically the largest group of creditors and a major source of finance. As such, you should give proper attention to payment terms and paying them on time, which impacts the commercial relationships and your business credit score.

Practical tips:

- Negotiate and optimise payment terms from vendors. These should be assessed and renegotiated periodically.

- Pay on time. That’s key to building your business’ credit score and improving payment terms over time.

- Notify your vendors in advance of any expected late payments.

Using the right credit products — small businesses need credit because they are either: 1. growing fast, 2. have a temporary cash shortage due to inherent cashflow volatility, seasonality, or an unexpected event, or 3. they lose money… These three types of businesses have very different financing requirements and suitable credit products. Credit mix optimisation can increase your profitability and liquidity and reduce the risk of running out of cash.

Practical tips (a professional advice may be required):

- Understand why do you need credit for, and

- Use the right credit products and align the credit mix accordingly

Don’t forget tax — another source of unexpected expenses and financial distress, which small business owners tend to (un)consciously ignore.

Practical tips:

- VAT is not part of the business cashflow — try to exclude from your cashflow a proxy amount of the expected (net) VAT payment and include it in your forecast

- Assess your corporate tax liability enough time in advance and make sure you have the resources to pay it

Stay agile — Darwin said: “It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is the most adaptable to change”. Truer than ever for small businesses! Cashflow wise, operating leverage is the indicator that measures the business’ adaptivity to change. In simple words, operating leverage is the relative impact of a change in your revenues, on the net profit; e.g., at which rate your net profit will decrease if your revenues suddenly decrease by 20%? The answer to this question depends on the short-term fixed/ variable costs ratio and your ability to reduce costs upon occurrence of certain events. The more flexible your operations, the higher the probability that your business will survive sudden changes.

Practical tips:

- Know your cost structure, and try to find the best trade-off between flexibility (option to reduce/ eliminate in a very short notice) to profitability (as in most cases early termination option will translate into higher costs) for all material costs.

- If possible, retain keep the option for immediate termination of substantial contracts.

This list is not conclusive. While it consists of some basic hygiene factors and ‘street wisdom’, it’s still rarely used by SMEs as a whole. As banks and accounting pack providers fall (way too) short of providing SMEs with such tools, and while some of the above tips may require professional support to execute, the majority of those practices are self-serve, and could turn into valuable digital tools for SMEs in the form of (for example) smart digital assistants, advanced cash management engines, and linking in new insurance products. It’s up to the fintech industry to build these tools and make an actual difference for SME owners to own the financial health of their businesses.

Gilad G. Amir is an EIR at Pollen Street Capital and a Steering Committee member of FinTECHTalents