Know-your-customer (KYC) checks have long been associated with high levels of customer friction. Traditionally, these assessments were largely carried out by financial institutions, conducting due diligence to safeguard against financial crime. Creating a seamless customer journey was not a priority in the design of legacy identity proofing systems.

Until recently, customers looking to open up a bank account would expect to take paper-based documents into a bank branch, for representatives to assess whether the credentials are match the identity of the individual in front of them. This process of identity proofing is inconvenient for customers, costly for businesses and problematic from a security perspective, as human error may lead to fraudulent credentials being overlooked.

Evolving Challenges in a Digital-First World

As more and more consumer interactions have shifted online, enterprises in all sectors are having to engage in KYC to securely verify the identities of customers opening accounts. The more consumers are required to repeat this process with each online service they register for, the greater the demand for frictionless identity proofing.

‘The Battle to Onboard 2020’ a research report by Signicat, found that 25% of consumers describe account applications as ‘between difficult and painful’ to complete. Respondents found processes to be time consuming and require too much personal information to be given away. A shocking 63% of European consumers surveyed, had abandoned a financial onboarding process in the past year.

The more customer accounts are opened digitally, the greater number of access points for those looking to commit fraud. If banks, mobile network operators and many other businesses have to enrol customers without meeting them in person, they need to be able to trust that an individual is who they say, rather than a fraudster or bot. Secure digital identity proofing has now become crucial.

New Approaches to Identity Proofing

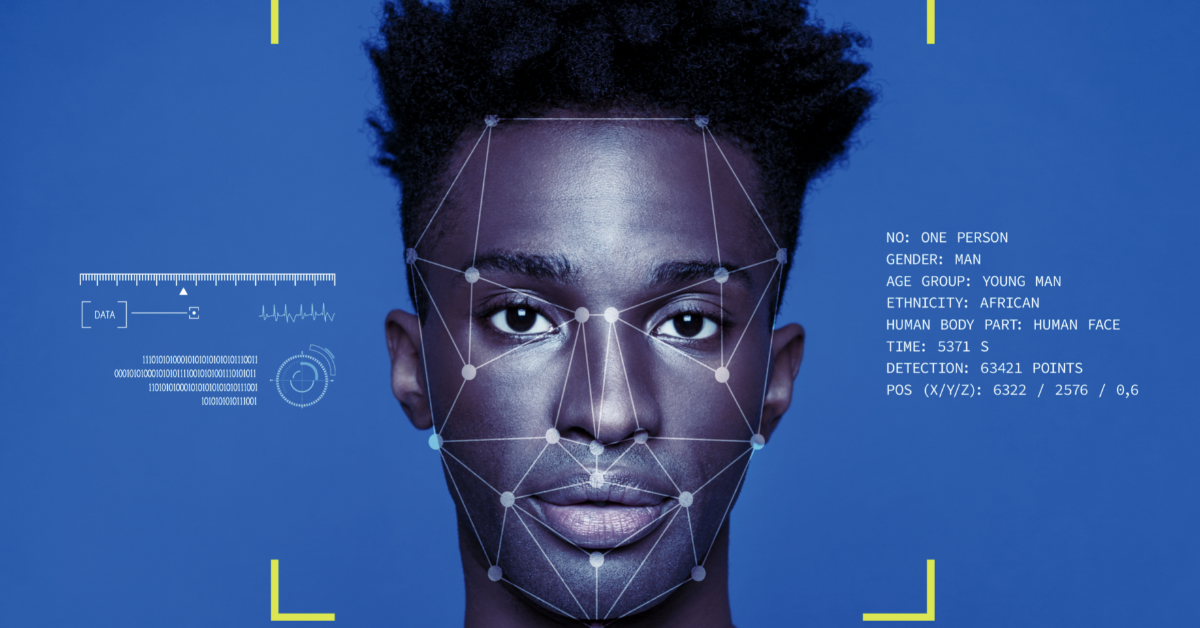

Traditional approaches to identity proofing utilizing subjective human assessments, are not sufficient in today’s digital landscape. Many banks and other enterprises are deploying new technologies throughout their onboarding processes, including mobile document scanning, biometrics and advanced analytics.

These digital methods offer convenient, real-time solutions to identity proofing, allowing customers to be onboarded remotely, but securely. But while some customers will eagerly embrace new technologies, others will not be comfortable with these process due to privacy concerns or limited technical capabilities. Inclusion has to be taken into account when building an onboarding process.

Enterprises that have been able to implement digital onboarding technologies will likely have seen the benefits. The Paypers, Digital Onboarding and KYC Report 2020 reports that financial institutions can now onboard new investors in 5 minutes, online credit registration takes just a few minutes and signing up for an insurance account takes just 30 seconds. All of these processes would have once taken at least 4-5 days.

Branch Banking is Out, Mobile is In

The growing appetite for remote onboarding was not unprecedented, given recent trends in digital banking. In a world where mobile banking has overtaken, it seems outdated that a customer who already manages so many financial tasks from their mobile device, should have to visit a bank branch to open a new account.

Even prior to the COVID-19 pandemic, face-to-face banking was in decline, reflected in the growing popularity of digital-first challengers, such as Monzo and Starling. CACI research predict that from 2017 to 2022 mobile transactions will increase by 121%, and by 2022 the average consumer will visit a bank branch 3 times a year or less.

Earlier this year, HSBC announced the planned closure of 82 UK branches between April and September. Jackie Uhi, HSBC UK’s Head of Network noted that the closures were not a direct product of COVID-19, instead pointing to increased adoption of digital alternatives and a decline in branch usage. In fact, Uhi highlighted, only 10% of customer contact now happens through HSBC branches.

The HSBC experience appears to reflect a long-term trend. According to consumer group Which?, more than a third of UK bank branches closed between 2015 and 2019. As in-person presence declines, the pressure for banks to enable end-to-end remote services only grows.

As a result, even prior to the pandemic customers were increasingly offered digital or hybrid options for completing KYC. A survey running from 2019 to early 2020, revealed 68% of financial institutions were already engaged in initiatives related to digital identity verification.

The Impact of COVID on Speed to Market

Whilst the circumstances surrounding COVID-19 are not solely responsible for shifting consumer appetite, we cannot ignore the drastic acceleration towards digital over the past year. Business around the world turned to technology as a means to continue with everyday meetings, tasks and procedures that previously were only carried out in-person.

Financial institutions were left with no choice but to allow consumers to open accounts, apply for loans and carry out transactions, through online and mobile channels. A greater urgency existed than ever before to remove any physical touchpoints left in the onboarding process.

Of course, fraudsters were also quick to capitalize on a drastic change in circumstances, finding new opportunities to commit fraud or generate illicit funds. Financial institutions have been forced to react to a rapidly evolving threat landscape while continuing to meet regulation. Those who were able to incorporate digital identity proofing to their online offering, were in a far better position to adapt to the ‘new normal’ we find ourselves in.

The Race Between Technology and Regulation

A significant challenge has been the extent to which regulation could keep up and make sufficient allowances for the unpredictable, knock-on effects of the pandemic. In a June 2020 post for example, Lexis Nexis reported that banks and insurers were unable to accept electronic death certificates for customer offboarding, even where this was the only option available to coroners.

While desperate times may call for desperate measures, there was still a need for caution to avoid drastic, permanent changes to regulation that might have unperceived risks later down the line. Looking to the future, if physical document checks are ever to be fully removed from the onboarding process, regulators will need to identify any legal restraints which prevent banks from meeting compliance guidelines through digital identity proofing.

Singapore is one such success story, where the government certified digital citizen ID ‘My Info’ as an independent and reliable source for identity proofing. As a result, more than 60 financial institutions are leveraging MyInfo to onboard customers, without needing to obtain physical identity documents. In Europe, where KYC and AML policies still need standardization, this will likely be more complex to achieve.

In the digital-first landscape ahead, financial institutions and many other enterprises will have to consider secure, digital identity proofing in order to meet customer needs, while managing risk and regulation. In many ways the pandemic has only highlighted the urgency around KYC and AML procedures, no longer suited to a digital world.

Laura Camplisson, Future Identity Portfolio Lead, VC Innovations

Join a growing community of policymakers, technology providers, enterprise end-users, and leading associations on 15 & 16 November for the Future Identity Festival.