Kallyas is an ultra-premium, responsive theme built for today websites.

T (212) 555 55 00

Email: sales@yourwebsite.com

Your Company LTD

Street nr 100, 4536534, Chicago, US

Open and in control? A consumer perspective Once a radical idea in the banking industry, open finance has now become commonplace. The benefits to consumers and financial institutions alike is clear with this data revolution offering people more control over their finances than ever. Innovation is also being fostered thanks to open finance giving customers access to

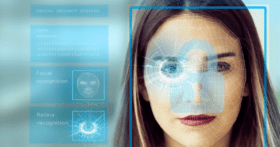

Fighting money laundering with face biometric verification The Financial Conduct Authority (FCA) wrote an open letter in May 2021, to retail banking chief executives in the UK. It raised concerns surrounding weak financial crime controls and anti-money laundering (AML) compliance in the sector. UK retail banks were mandated to analyze, identify, and resolve issues around “common control

Rod Boothby, Santander’s Global Head of Identity and co-chair of the Open Digital Trust Initiative at the Institute of International Finance (IIF), explores what the number of people taking to search engines to ask how to “Login”, reveals about the challenge of online identity. Identity is the largest unsolved problem on the Internet. How do

The advent of Fintech disrupters fundamentally changed the financial sector. Many established incumbents embraced innovative cloud solutions in a bid to gain a tech advantage over up-start competitors. But the rapid pace of innovation is a challenge for all financial firms, with a balance between maintaining complex technological ecosystems and incorporating new tech not being

A wide variety of methods are available to authenticate users remotely, ranging from passwords and one-time passcodes (OTPs), to fingerprint scanning and face authentication. Each relies on a different factor to establish trust: Something you know (like passwords) Something you have (using your phone for OTPs) Something you are (biometrics, such as your face). In recent

Rod Boothby, Global Head of Identity at Santander, explores how the failure to verify every software developer’s digital identity, creates a backdoor for hackers, increasing the threat of ransomware and other cybersecurity risks. Most people do not know how modern software is built. People imagine a lone brilliant developer retreating into a dark room for

The relevance of building societies amongst younger savers Attitudes towards banking have rapidly shifted in recent years as younger, tech-savvy customers enter the marketplace. Digital native users expect a smooth and seamless banking experience, no matter if they are in-branch, online or on their mobile. A recent poll by the deVere Group found that 59% of their surveyed clients born between 1980 and 1996 either

Fintech for Travel – Embedded for a Rebound? The travel and tourism industries were among the hardest hit from lockdowns and restrictions introduced by governments around the world to reduce the spread of COVID. According to statistics from the Office for National Statistics, in Q2 2020 overseas residents spent 97% less than in Q2 2019 on their visits to the UK, highlighting the stark

Global identity verification and fraud prevention provider Ekata, explore the findings of a survey in which they interviewed top global merchants on their experiences surrounding PSD2. The revised Payment Services Directive (PSD2) went into effect this past January 1st for many countries across Europe. The payments ecosystem had been hard at work for the past

It’s fair to say that building societies are having their full-circle moment. Looking back at the financial crisis of 2008, we saw some building societies abandon their mutual ethos with goals to compete with larger banks. But as we now know, the goals of obtaining larger stakes in the market and the promise of future