There is some debate over when the word ‘FinTech’ first came into use. I remember it being used in my New York office in the mid 1990s as a shortened, pre-hashtag, version of Financial Technology, there is evidence of a Sunday Times column from Peter Ridder that was called ‘FinTech’ in the mid 1980s, and my good friend Ali Paterson claims that FinTech was first recorded being used as early as the 1970s. However, FinTech came into popular use following the explosion of new entrants into the financial services market post the crash of 2008.

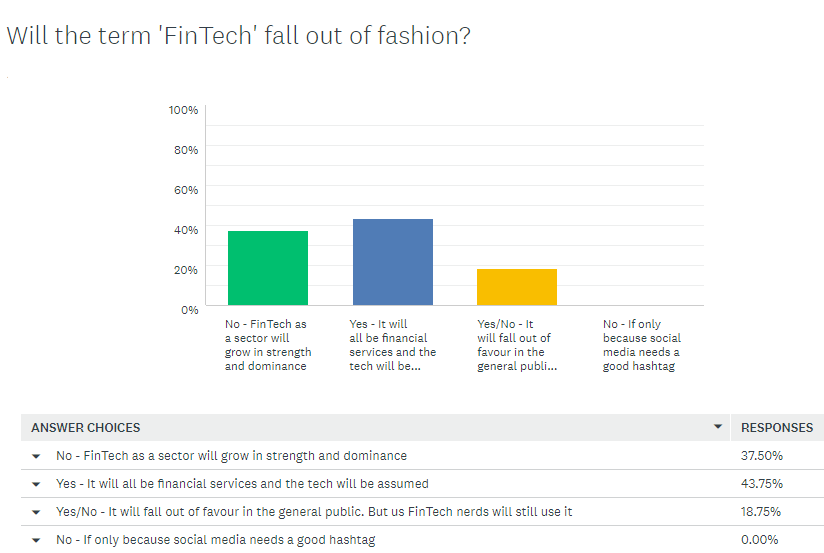

But has the term ‘FinTech’ we know and love, come to the end of its life cycle – FinTech as a word, or a verb or as a description? At our FinTECH4Life event Vica Manos, managing director at Anthemis Group commented that they do not use the term ‘FinTech’ inside their venture capital operation. “We say Financial Services and the tech is assumed,” she said.

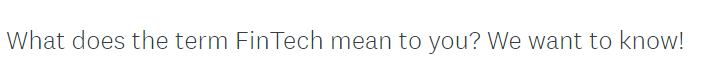

This prompted me to send out a wee survey to find out what our community thinks. And you guys responded. Here are the results:

- “For me it means democracy in banking and finance.”

- “10x Revenues instead of 10x P/E Ratio :-)”

- “FinTech is a label applied to new entrants which in reality also covers existing companies. It’s the use of technology to improve banking from apps to AI.”

- “Technology in Financial Services industry”

- “For me, it’s a response to what happened in 2008 and birthed by movements like Occupy. If the industry is broken (and just look at the fines we are still seeing!!) then it needs a catalyst to change. Regulation is not the only answer, it doesn’t form character, and still now we are seeing the unintended consequences in areas like de-risking in emerging market finance and the collapse of correspondent banking in those areas. Fintech is a disruptive mindset with a desire to make things better, more inclusive, fairer, it’s an agility, and a social conscience which we have all but lost elsewhere in the industry. (Apologies for the rant:-))”

- “Financial plus Technology. Simples”

- “The end of bank as a noun and the growth of banking as a verb”

- “Just another self serving buzzword that adds little and serves to exclude others creating a largely undeserved premium and cachet.”

- “Startups in financial tech”

- “Using technology in financial services which basically powers…everything. But ideally using technology in new and different ways vs before.”

- “Shorthand for innovation / disruption”

- “FinTech is the hope of using technology to build a better, more robust and resilient financial ecosystem. Whether that is directly through to consumers with PFMs, or building out trading algorithms (and corresponding algorithms to monitor and regulate risky trades), its all FinTech. And it SHOULD be done for good and for the better. In practice, not always the case but we can hope!”

- “An approach to solving financial issues – new services, new approaches to old products, through the application of technology.”

- “Using technology in financial services – to improve existing operations / processes, or to create something new. (But it’s not something new! It’s been around for a while…and it’s not just confined to startups.)”