Country music and red wine fan, Antonio Virzì seeks to turn Android & iOS smartphones into secure and easy-to-use personal devices that can replace traditional smart-card and token-based digital identities allowing users to easily authenticate online, authorise transactions, sign legal documents, provide consent and more.

What does biid do – what problem are you solving?

biid is a ‘mobile identity’ platform that secures and protects digital infrastructures while allowing users to easily authenticate online, authorise transactions, sign legal documents and provide consent, all in accordance to the new eIDAS, GDPR, PSD2 and Open Banking requirements in Europe and internationally.

Our mission is to ‘help Governments and Financial Institutions to address the digital identity problem and make our society safer for everyone’.

Who uses biid – who is it aimed at?

biid is a B2B technology company selling a modern ‘digital identity” platform to large and medium enterprises.

In most recent years our core focus has been in the Financial Services and Smart City markets, helping our customers to legally identify digital users via their smartphones.

To give a couple of concrete examples:

- A citizen of Barcelona can use the ‘Mobile ID’ App powered by biid’s technology to log into the city council’s website, pay their taxes, check their parking tickets and access a variety of digital services offered by the administration.

- Customers and employees of one of our banks’ customers might use their mobile banking app powered by biid to access their bank account, sign new contracts, provide consent to share their data, authorise payments and more.

How is it secure – how does it compare to other identity applications?

At the core of biid there is our mobile PKI technology, turning Android & iOS smartphones into secure and easy-to-use personal devices that can replace traditional smart-card and token-based digital identities.

Our customers embed the biid mobile SDKs into their existing Apps, transforming those Apps in the user’s authenticators.

As an example, in case of an online authentication into an online banking site, a user might be asked to provide their username on their bank’s homepage and, after clicking the on login button, he might receive a push notification on his ‘certified device’.

On this device the user would then be asked to authorise the login using different biometric methods (e.g. fingerprint, face recognition, 4-fingers validation, etc.).

In background biid’s technology would then perform additional checks to validate the user identity and authorise the requested access, all without the user having to do anything else. These background process would include, among others, the cryptographic validation of the user identity, adopting a digital signature validation.

biid’s technology is also already integrated with a Quantum-based ‘true Random Number Generator’ to provide military-grade encryption while delivering best-in-class user experience for consumer, enterprise and industrial applications.

There have been many instances of fraud, data breaches and stolen customer data – in several industries – are banks doing enough to protect our data and protect us from digital fraud? Banks are starting to bet big on the digital, and in particular mobile. This means that their exposure to digital fraud is also massively increasing and they are well aware of it.

Problems like the one that resulted in the Tesco Bank hacking, or issues like phishing are of great concern, and we see every bank trying to address these issues.

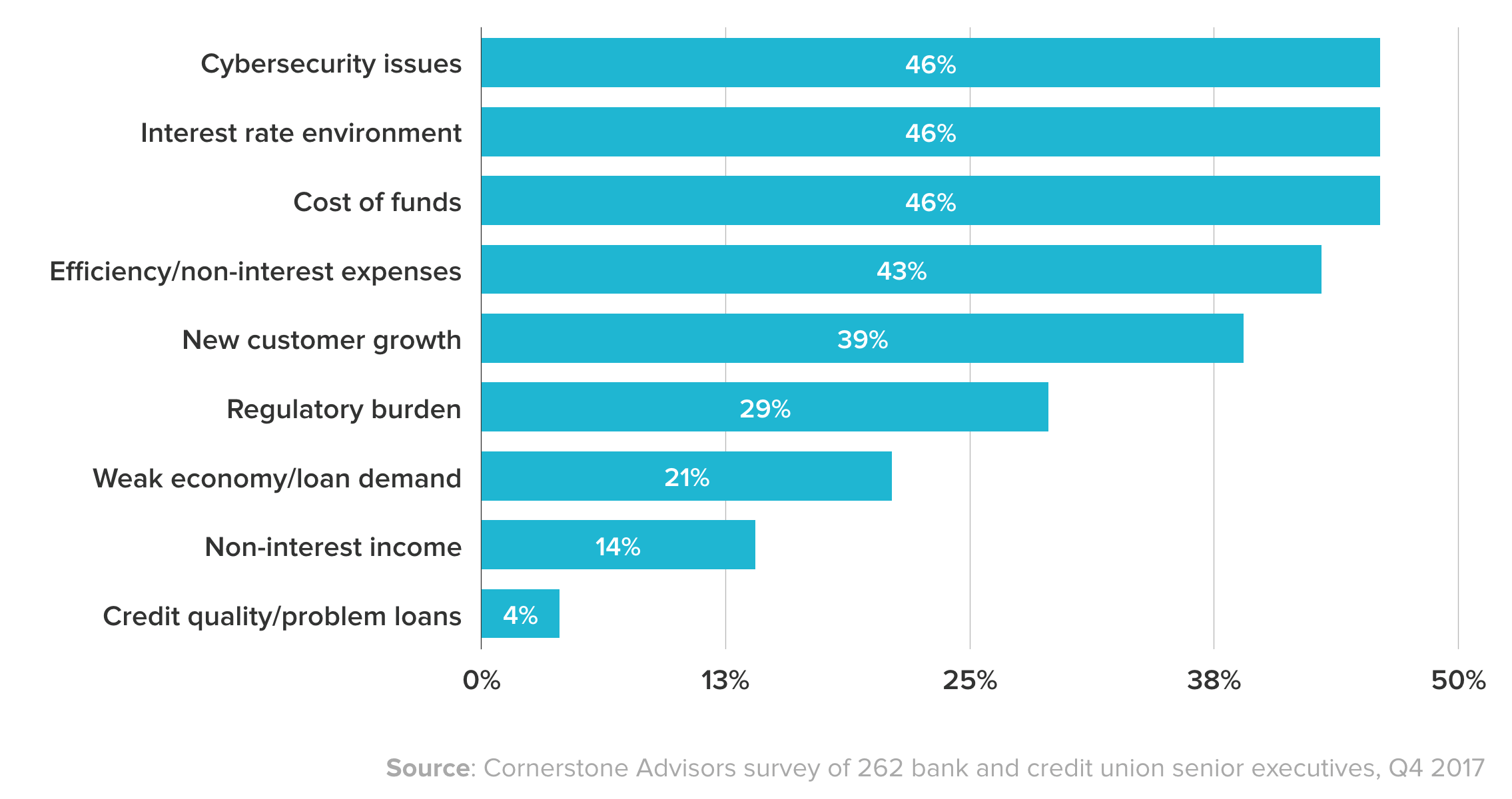

Among bank CEO top concerns for 2018, cybersecurity is at the top of the list.

At biid, we help banks to face exactly those kind of issues, by first and foremost providing a solution to secure bank’s API as well as removing the risk of phishing attacks.

With regards to data protection, the complexity of the issue is enormous, as customer data today is spread across a vast number of different systems and infrastructures.

biid’s Identity Platform was built from the ground up taking into account ‘Privacy by Design & Default’, as dictated by the new European General Data Protection Regulation (GDPR). In a world where “data is the new money”, as an organisation we made the conscious choice of not being a data company. As a matter of fact we are a cyber security company and we built our product to allow our customers to secure their data and digital infrastructures.

This approach can be seen in many aspects of what we do: from the technology and architecture we’ve chosen to build our platform, to the advanced cryptographic tools we’ve built to protect personal data, to the processes we enforce both internally and with partners, when managing sensitive data and information.

You are a veteran entrepreneur – can you share one of your most important startup lessons?

The best product DOES NOT always win, but if you are a small startup selling to banks, make sure you have a phenomenal product that solves the real problem and does it well. Cash is king. Make sure you don’t run of money and you can pay the bills. You will sleep much better at night.

Europe is not the US, when it comes to building a business, raising money, going for a particular business model. Understand the differences and build a sustainable business, based on the environment you are in.

We will have many varieties of craft beer on offer at the Festival – including one developed by artificial intelligence – if beer was your identity, what would it taste like?

I am more of a red wine kind of guy, although I am not really an expert on wine, either.

You may have heard about our ongoing FinTECHTalents Spotify Playlist – What would you like to add?

I am a Country music lover. I would add some Sam Hunt and Kenny Chesney, if I could.

Alternatively, I would not mind at all some John Mayer.