Belgium-based robo-advisor Investsuite makes a play for the B2B market with their own proprietary VaR approach and a team of senior bankers, computer and math experts, designers, and sector specialists who ‘understand how a real bank works.’ Bart Vanhaeren, CEO & co-founder discusses the growth of the robo-advice market, how he has never been a ‘typical banker’ and the type of beer he would develop using artificial intelligence would definitely be ‘Your Beer’.

Your company sits in the robo-advice category – which is a crowded market – how do you guys stand out?

First of all, it is very important to consider that a majority of EU (and worldwide) robo-advisors have a standalone B2C model. i.e. they go directly to the end customer. We don’t believe in that model and the current market reality shows our belief is justified. There are 100 robo-advisors in Europe and all together they have a very tiny part of the market (max five billion but more like three billion).

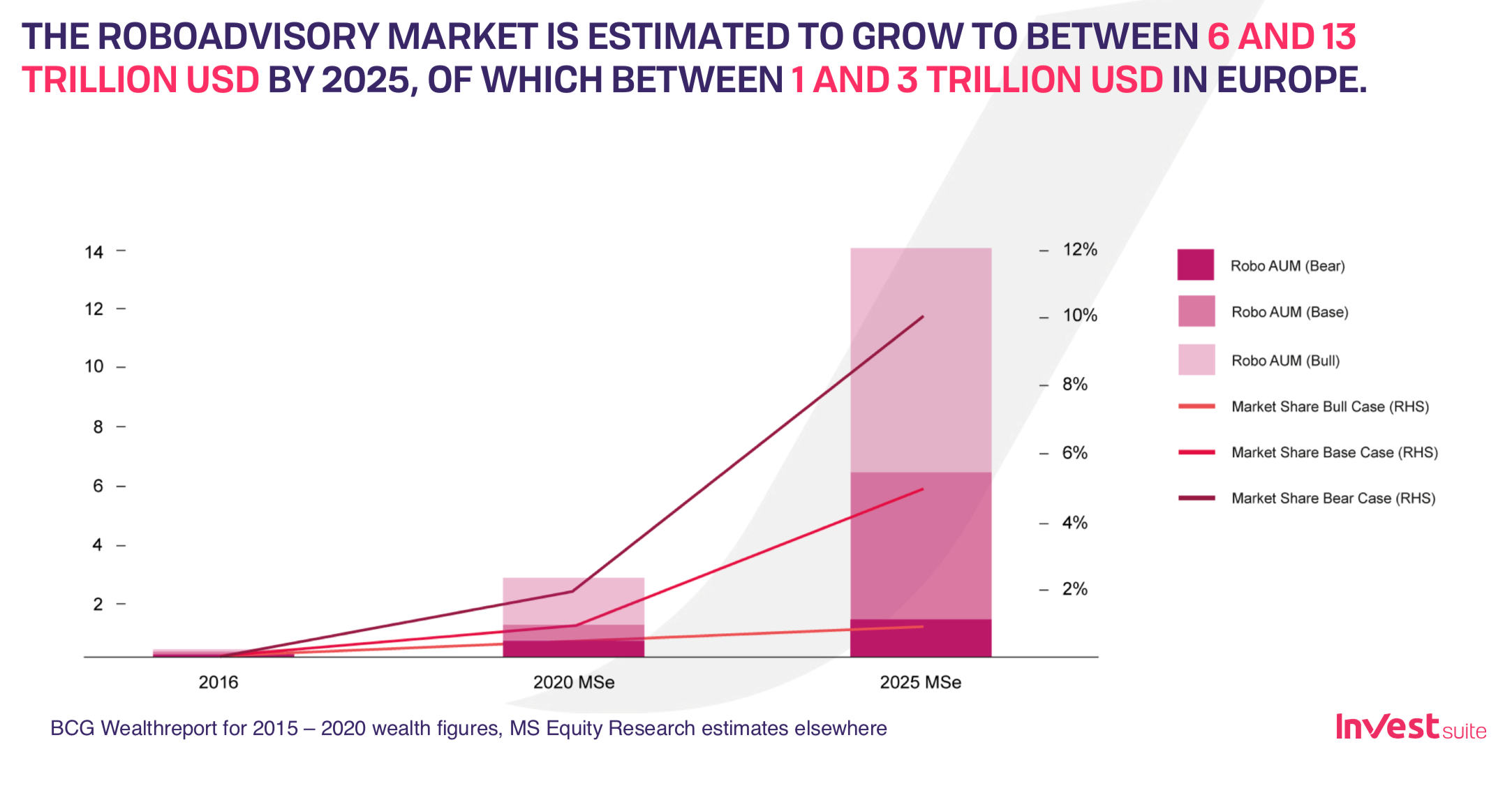

Have a look at the following numbers. They show a potentially huge market, but the current share of all these robo-advisors is tiny, and they have been operating between two to five years.

You talk about the importance of collaboration between new FinTech entrants and traditional financial firms – establishing a bridge between the two. Unlike other robo-advisors, Investsuite is a B2B FinTech rather than a B2C…

The reason that B2C does not really work is the very high cost of customer acquisition and issues related to trust.

So, a first clear differentiator is that we are – from the start – a pure B2B player. Some robo-advisors like Scalable are pivoting to B2B but our claim is that we are the real deal and have ‘no double agenda’.

Following on from that is our business view: we aim to integrate into the systems of banking software providers (core banking systems and Portfolio Management Systems) architecture via an open API approach. We are already in advanced in talks with several providers. Once API links are built, implementation can go much quicker.

Furthermore, we have a truly differentiating algorithm. 75% of robo-advisors use basic Markowitz and volatility as risk parameter. Some more advanced players use second generation risk definitions like Value at Risk (VAR). We have developed a fourth generation proprietary risk approach which we label iVaR.

We believe to that we have composed a very complementary and senior team of senior bankers, computer and math experts, designers, and sector specialists. One key difference, compared to most teams is that the senior people in our team have actually previously developed and launched highly successful digital fintech platforms in the market. And it is a team that understands how a real bank works.

Finally, MIFID is a key regulatory requirement. Two senior members of the team were responsible for MIFID at their ex employers and a partner from EY, a MIFID expert, is a member of the Advisory Board.

Do you have any performance metrics you can share – comparing retail investment advice from a human with your offering or with rival robo-advice services?

Actually, we don’t, because ‘performance’ is very hard to compare\measure. But I’ll try to give some input for this question:

- The ETFs we use are much cheaper than if a human being composed a fund. Just look at the cost of running an asset manager.

- The typical performance could well be 1 – 2% better because most fund managers don’t beat the market and the higher costs eat the returns away.

- The costs associated with advice could drop radically as the full process is automated. So, basically, you take out 80% or more of the costs needed in case of face to face advice

You came from a traditional financial services background – why did you make the jump to a startup – talk us through that experience.

Great question! To give a bit of context. I am actually an engineer by background: MSc Chemical IR and MsC environmental IR. I started as a consultant with Arthur D Little and moved on to Levi Strauss and GE Capital working in the EU, Africa, the US, Latin America and sometimes the Middle East. That gave me a great view ‘upon the world’ and as such I was never a ‘typical’ banker.

On the contrary, when I joined KBC Bank I became Head of the Organisation Department I was responsible for large strategy projects, reorganisations and M&A. I was then asked to ‘start a startup’ That was KBC Consumer Finance, which I scaled to 2000 people in 5 countries. Later I was asked to ‘re-found’ the bank’s digital trading platform. This platform resulted in KBC Securities/Bolero winning three awards three years in row for best broker and an international innovation award.

During my final few years at the company, I became heavily involved in the startup world. I wrote a book about startups (Get Up Startup), I founded an equity crowdfunding platform (Bolero Crowdfunding), was a startup mentor, headed the in-house VC fund and was board member at startup ecosystems. I was also head of Innovation at the investment bank. As such I was never the typical banker, but rather an in-house entrepreneur/intrapreneur who founded three companies. At the end, I had a strong desire to continue along the entrepreneurial path and felt that my experiences and expertise would be an ideal platform to leave the ‘golden cage’. I liked working at the bank, but there is nothing better than being a true entrepreneur, ‘building and growing’ people and companies. Hence the ‘jump’.

Laurent Sorber, my co-founder and math wizard developed his own B2C robo-advisory three years ago. I was asked to become his startup mentor and was blown away by his intelligence and his algorithm. But I told him that B2C would be very hard. As it turned out, a year later I became responsible for KBC’s in-house robo programme and thought it would best to use a B2B service, which was not available in the market. To make a long story short, we thought many banks would be struggling with the same problem that I did whilst I was a board member. We decided to join forces and set up our own…B2B robo-advisory to solve a problem I had experienced myself as a banker.

We will be offering the delegates of FinTECHTalents craft beer that have been ‘optimised for the FinTech audience’ using AI. (Given Investsuite is based in Belgium) Can you describe your own beer, if you could design it using AI?

Our own beer: fantastic! A bit of extra info…You may know that Belgium is a beer country. Leuven is the beer ‘capital’ where Stella Artois/AB Imbev has its origins. Leuven is the HQ of Investsuite. Even better, our office is in one of the main buildings of the brewery and we are surrounded by kettles and machinery, which gives a very cool industrial look and experience. So…if we were using AI…I would develop a beer that could gauge the ‘mood’ of the customer. It would take into account all sorts of parameters like, temperature, time of the day, etc and based upon all that come up with the ‘right beer’. It would use feedback loops and ‘training’ to adjust the taste until it is perfect.

We could call it ‘Your Beer’.