With digitisation, comes changing user behaviour, increased risk, and an evolving regulatory landscape. The need for trusted digital identity is clear, but which factors will drive widespread adoption across different sectors?

How can digital identity solutions gain user trust, by keeping in mind privacy, data protection and ease of use? Which solutions will gain support from businesses, by allowing them to optimize security while remaining compliant?

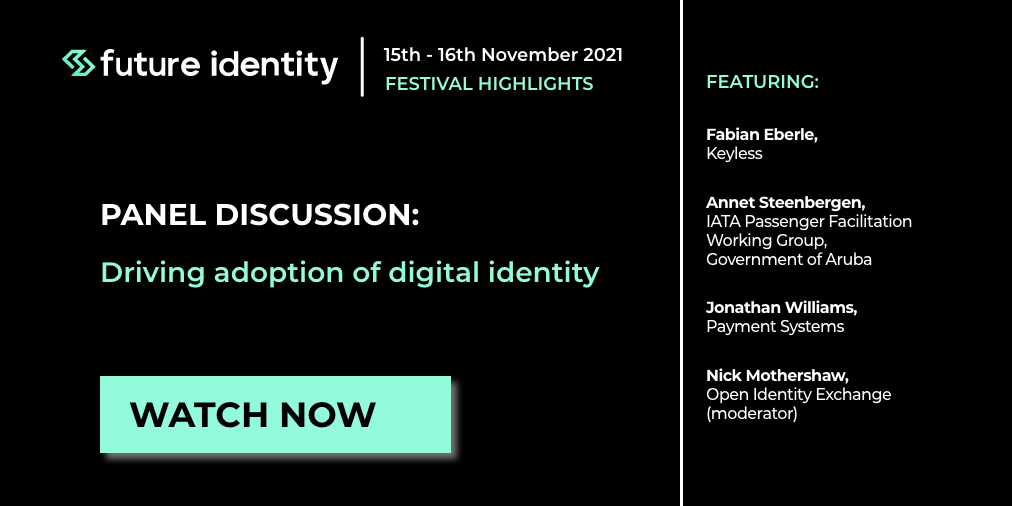

At the Future Identity, and Fintech Talents festival 2021 we were joined by a panel of experts to discuss the demands, trends, and incentives, encouraging businesses and users to adopt digital identity technology.

As Co-Founder and COO of Keyless, Fabian Eberle, represented the point of view of an identity technology provider, highlighting what users and organisations stand to gain from adoption – “Digital identity is the front door to pretty much anything we do, whether that’s banking, education… and now in the world of a pandemic everything has gone digital and remote, so we need a secure but also convenient way to verify that we are who we claim to be online.”

Finally, Jonathan Williams from the Payment Systems Regulator represented the financial services sector perspective, noting that adopting digital identity solutions could help massively in mitigating fraud, particular authorised push payment fraud, “there’s a challenge when we’re accepting things like payment details and we want to be able to link that bank account to the actual person or company that we want to pay. That’s one of the challengers the PSR has done a certain amount of work on.”

Find out more, by watching the full session recording below: