Designing digital identity to meet high levels of trust, while ensuring credentials are interoperable, portable and protect the holder’s personal data, is no easy task. Customers are becoming more and more aware of their online identities, they want security, data privacy and control.

On many occasions, when verifying your identity online you are really verifying your eligibility for a certain product or service. Yet users often have to share more information than is necessary for the specific transaction. Worse still, they have to do this time and time again, with different services providers.

Many advocate for a decentralized identity model to address this issue. Control is placed back in the hands of consumers, who become the guardians of their own verified information, collected from certified issuers.

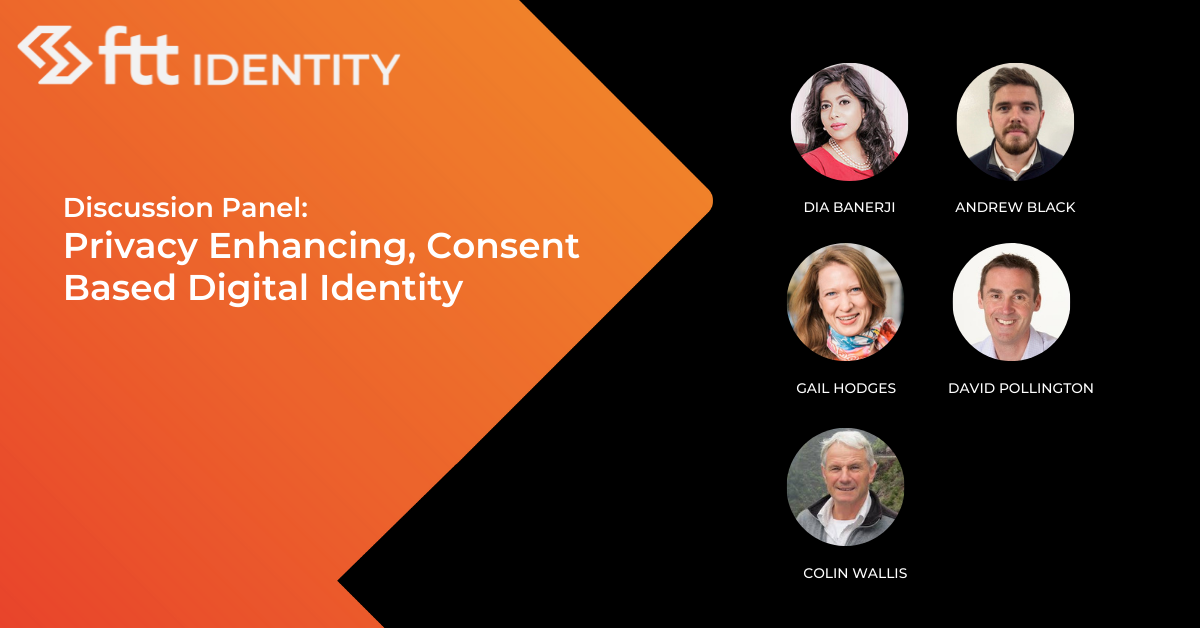

The model is gaining traction, with new decentralised KYC solutions emerging onto the market constantly. At FTT Identity 2021, a panel of experts shared their predictions on the impact decentralised identity will have on financial services? Will financial institutions embrace the model in the years to come?

Dia Banerji, Country Ambassador, Scotland, Women in Identity

Could there be decentralised identity in financial services? Absolutely yes. At the end of the day a decentralised economy needs a decentralised identity system. But decentralised identity only works when you have mass adoption, resulting in a chicken and egg scenario. Financial services is not an industry known for its collaborative nature, banks are liable to the regulators independently, without the right level of collaboration you won’t have the necessary trust framework. I would love to see decentralised identity in financial services and every day there is development of technology which brings this closer to reality. When it happens, remains to be seen.

Gail Hodges, Founder, Future Identity Council

Identity technology is fragmented but there are two major types, decentralised, reusable credentials and digital versions of government issued IDs like drivers licences. I think of it as the hare and the turtle. Decentralised IDs from private entities can move pretty quickly, while government ID schemes are moving a lot more slowly. But both are trying to reach the same finish line where citizens can assert who they are online, with ease. Keep in mind that citizens do expect their governments to continue playing a meaningful role in identity. It could be that the two technology types are interoperable – a government issued ID could help a decentralised KYC service to provide more assurance of a customer’s identity.

Andrew Black, Senior Digital Product Owner, Data, Open Banking & Digital Identity, NatWest

Financial services as a whole sees the benefits to decentralised identity – reduced operational costs, streamlined onboarding processes, there is huge opportunity here for banks. The question is will regulation allow this to happen, and when? How pure of a decentralization will it be? Are we looking at public interoperable blockchains, or hybrid systems combining self-sovereign and federated identity? The appetite is there to test, pilot and learn. Technology as usual is not the challenging thing, for financial institutions regulation is the ‘tortoise’.

David Pollington, Senior Director, Technology & Product, GSMA

Its difficult to look into the future, the question really is should banks embrace decentralised identity and why would they do this. For any regulated industry, the cost of knowing your customers is very high. Being able to reuse KYC data from a customer’s previous accounts would reduce costs. If the government is the one issuing the credentials, there is an audit trail by which to validate the authenticity of these proofs. So there are lots of good cost benefits and benefits to customers, but will banks embrace decentralised identity? There are a lot of commercial, technical and regulatory challenges which make it hard to say.

Watch the full session below:

For more topical and interactive content focused on the rapidly evolving world of digital identity, join our new community Future Identity today.